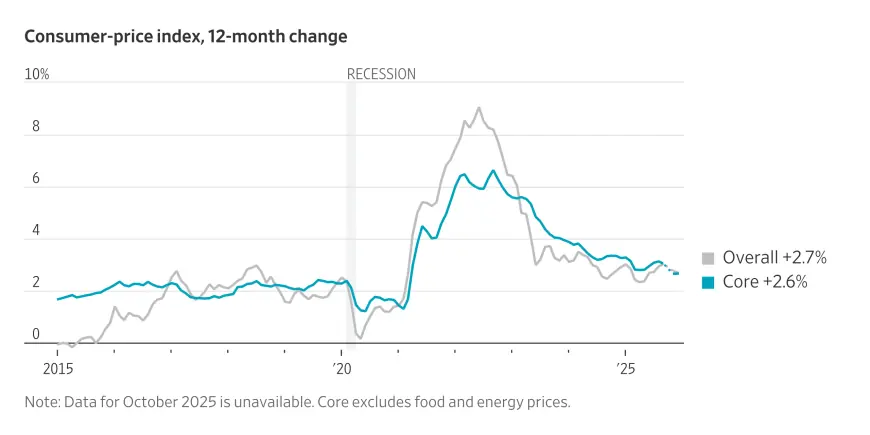

CPI Inflation Rate Slips to 2.4% in January, Offering Fed Breathing Room

U. S. consumer price growth cooled at the start of the year, with the headline CPI inflation rate easing to 2. 4% in January from 2. 7% a month earlier. Core inflation edged down to 2. 5% year over year. The latest reading, released Friday (ET), suggests disinflation remains intact even as some service categories stay firm.

Headline price growth cools

Data from the Bureau of Labor Statistics show overall consumer prices rising 0. 2% in January from December, a slower monthly pace that helped pull the annual rate down to 2. 4%. The step-down from December’s 2. 7% year-over-year pace marks a welcome turn after concerns that price pressures might re-accelerate.

The improvement offers a measure of relief after last year’s tariff-related bumps lifted prices in select categories. While the impact of those levies has so far been smaller than many feared, uncertainty over their full pass-through still hangs over the outlook.

Core inflation shows lingering stickiness

Stripping out food and energy, core prices rose 0. 3% on the month and 2. 5% from a year earlier, down a notch from 2. 6%. That slowing keeps the broader disinflation trend intact, but the level remains above the Federal Reserve’s 2% goal. The composition reinforces a familiar pattern: goods disinflation and energy relief countering still-sturdy services costs.

For policymakers, this mix argues for patience. Progress is evident, but the persistence in core services suggests the Fed will want more confirming data before contemplating an aggressive pivot on interest rates.

Energy drop offsets pockets of services strength

January’s details were mixed across categories. Food prices ticked higher, but only modestly. Energy costs fell 1. 5%, offering direct relief to household budgets and indirectly easing transportation-related inputs. Prices for used cars and trucks retreated, and car insurance costs also slipped.

Elsewhere, airfare prices jumped 6. 5% on the month, a sharp rise that cut against the broader easing trend. Personal care services advanced 1. 2%, recreational services increased 0. 5%, and internet services climbed 1. 8%. The divergence underscores how uneven the final stretch of disinflation can be, with demand-sensitive services proving more resistant even as goods prices and energy help cool the headline index.

Jobs and confidence paint a nuanced backdrop

The labor market began the year on firmer footing, with 130, 000 jobs added in January and the unemployment rate dipping to 4. 3%. However, annual benchmarking revisions showed the economy created 181, 000 jobs over the whole of 2025, well below earlier estimates and the slowest full-year gain since 2010 outside the pandemic year.

Meanwhile, consumer sentiment has softened notably. A key measure of confidence recently fell to its lowest level since 2014, reflecting ongoing concerns about day-to-day affordability, including groceries and other essentials. The combination—cooling inflation, slower job gains after revision, and cautious households—highlights a late-cycle economy still seeking balance.

What it means for the Fed and rates

The January CPI print came in softer than many forecasts for the headline gauge, reinforcing the case that inflation continues to trend lower. Yet the firmness in core services suggests the path back to 2% will likely be gradual. For rate-setters, that means resisting the urge to move too quickly. A longer run of benign monthly readings—especially sub-0. 2% to 0. 3% gains in core—would strengthen the case for cuts later in the year.

Markets and businesses will now watch for confirmation in upcoming inflation and wage data. If goods disinflation persists and shelter and other services cool more decisively, the window for policy easing widens. If services remain sticky or tariffs exert fresh pressure, the glide path could be bumpier.

What to watch next

Key signposts include the next CPI and the broader inflation gauges that feed directly into the Fed’s target framework. Seasonals, tariff effects, and post-holiday discounting can create noise early in the year; February and March data will help clarify whether January’s cooling marks renewed momentum toward the inflation goal.

For households, the mix matters as much as the headline. Continued relief at the pump and stabilizing goods prices can offset pockets of services strength. For policymakers, January’s report keeps the disinflation narrative intact—just not yet complete.