HMRC Rectifies Pension Errors, Apologizes to 800,000 Britons

A significant issue affecting state pension payments for nearly 800,000 individuals in the UK has been rectified. HM Revenue and Customs (HMRC) has publicly acknowledged the mistakes in pension forecasts, which risked the retirement savings of many Britons.

Details of the Pension Error Correction

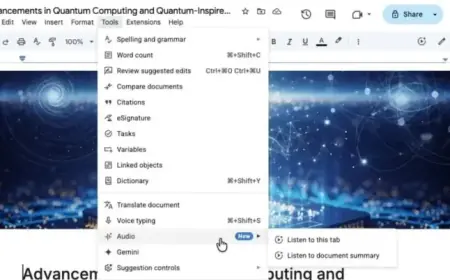

On February 14, 2024, HMRC made a crucial announcement regarding a defect in its online state pension forecast tool. This fault had been present for nine years, primarily impacting individuals who had “contracted out” of the additional state pension and were approaching retirement age after April 2029.

Background of the Error

- The error was first reported to government officials in 2017.

- No corrective actions were taken until February 2024.

- The online forecast tool launched in February 2016 before the new state pension system.

- Within just three years, approximately 360,000 individuals received incorrect estimates.

Impact on Affected Individuals

The inaccurate forecasts misled many into believing they were eligible for the maximum state pension without any extra contributions. Affected individuals had redirected their National Insurance contributions to private or workplace pensions, which diminished their retirement entitlements.

This oversight could lead to pensioners receiving smaller payouts than they anticipated, without the means to compensate for the shortfall through additional contributions.

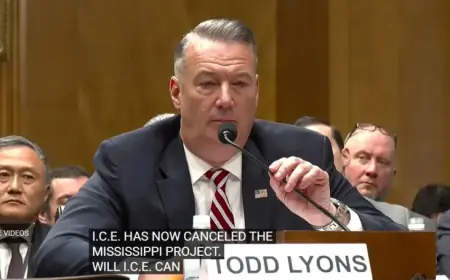

HMRC’s Response

HMRC has assured the public that updates to the forecasting tool will now more accurately reflect periods when individuals were contracted out of the state earnings-related pension scheme (SERPS). An HMRC representative issued an apology for the difficulties experienced by users due to the errors.

Steps for Affected Individuals

To qualify for the full new state pension, which currently stands at £230.25 per week, individuals must have 35 years of National Insurance contributions. HMRC has indicated that individuals who are affected can make lump sum payments of up to £907 for any missing year of contributions.

Sir Steve Webb, a former pensions minister, has stressed the significance of this correction. He remarked that retirees must avoid relying on forecasts that are “built on sand.” He also praised HMRC’s commitment to improving the accuracy of their projections.