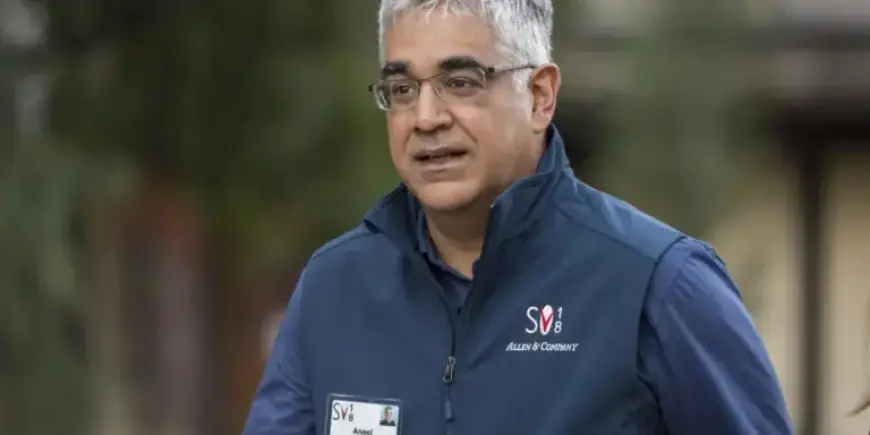

Founder Aneel Bhusri Returns with $139M Bet to Revive Workday’s $40B Loss

Workday has reinstated cofounder Aneel Bhusri as CEO, marking a return to a Silicon Valley trend where founders reclaim leadership to navigate significant challenges. His reinstatement follows a $40 billion loss in the company’s market capitalization, attributed to the AI panic affecting software stocks. With a substantial personal investment in the company, Bhusri’s unique vision is deemed crucial for steering Workday through this turbulent period.

Aneel Bhusri’s Comprehensive Pay Package

To entice Bhusri back to the top role, Workday has crafted a lucrative compensation package worth $138.8 million. Key components include:

- Performance-Based Compensation: Approximately $75 million is contingent upon achieving undisclosed stock price targets over the next five years.

- Restricted Stock: About $60 million in stock will vest as long as Bhusri remains with the company for four years, without performance conditions.

- Salary: Bhusri will receive an annual salary of $1.25 million and a potential yearly bonus of up to $2.5 million.

This pay structure reflects the company’s acknowledgment of investor skepticism surrounding the SaaS sector. Workday’s stock has dropped 51% from its peak, highlighting the volatility driven by AI’s impact on software enterprises.

Challenges Facing Workday

Since Workday’s peak market cap of $80 billion, the stock has plummeted, closing at approximately $150. This year alone, the stock has declined by 29%, reflecting a broader downturn among SaaS companies, including Salesforce and ServiceNow.

Bhusri’s leadership comes at a time when the company has faced significant operational shifts. Last February, it reduced its workforce by 7.5% to realign with market demands, resulting in substantial costs. Revenue growth is slowing, with total revenue for fiscal 2025 reaching $8.4 billion, up 16% from the prior year, but subscription revenue growth has dipped further to 15% recently.

Voting Control and Historical Context

Bhusri’s return may also be influenced by his and cofounder Dave Duffield’s substantial control over the company. Together, they hold 68% of the voting power through Class B shares, enabling significant influence over major decisions. Their dual-class share structure is set to expire in October 2032, after which the landscape of shareholder control may change significantly.

The Outlook for Workday

Bhusri expressed optimism about Workday’s future in a LinkedIn post, emphasizing AI’s transformative potential in the enterprise software area. However, analysts caution that the existing challenges will require more than optimism. Investors are anxious about whether Bhusri can effectively lead Workday through the complexities of this rapidly evolving market.

| Key Facts | Details |

|---|---|

| Aneel Bhusri’s Role | CEO and Chairman of Workday |

| Compensation Package | $138.8 million |

| Stock Price Decline | 51% drop from peak, now $150 |

| Workforce Cuts | 7.5% reduction in February 2024 |

| Growth Rate | Subscription revenue growth slowed to 15% |

With such significant stakes in his hands, Bhusri’s leadership is critical as Workday seeks to regain lost ground amid industry upheaval.