Mortgage Rates Decline Approaching Three-Year Lows

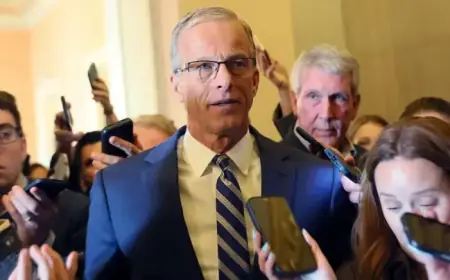

Sam Khater, the chief economist at Freddie Mac, noted that strong economic growth and a solid labor market have contributed to mortgage rates approaching three-year lows. This environment has significantly improved housing affordability, attracting many prospective homebuyers. Such factors have led to increased purchase application activity compared to a year ago.

Mortgage Demand Mixed Signals

Despite the positive insights from Freddie Mac, there are mixed signals regarding mortgage demand. According to the Mortgage Bankers Association (MBA), total mortgage applications saw a slight decline of 0.3% from the previous week. Furthermore, purchase applications dropped by 2% on a seasonally adjusted basis.

Refinance Index Surge

In contrast to the drop in purchase applications, the refinance index experienced a significant boost, more than doubling from a year ago. This suggests that while many buyers may be cautious, existing homeowners are taking advantage of lower rates.

Future Mortgage Rate Forecast

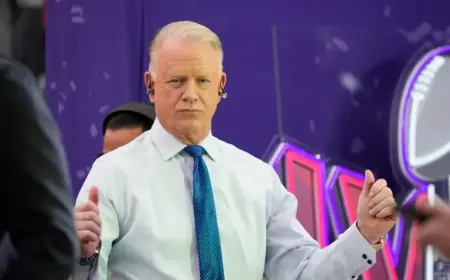

- Forecast Overview: Mike Fratantoni, the MBA’s chief economist, stated that mortgage rates are expected to remain in a narrow range in coming years.

- Rate Expectations: Economists do not anticipate a return to sub-6% borrowing costs soon.

- Long-Term Predictions: MBA’s latest projections suggest that 30-year mortgage rates will mostly stay between 6% and 6.5% until 2026.

This stability in rates is predicted to facilitate a gradual recovery in purchase activity instead of triggering a rapid refinancing boom. Homebuyers and industry professionals alike continue to closely monitor these trends as the housing market evolves.