U.S. Oil Prices Climb Higher Amid Market Shifts

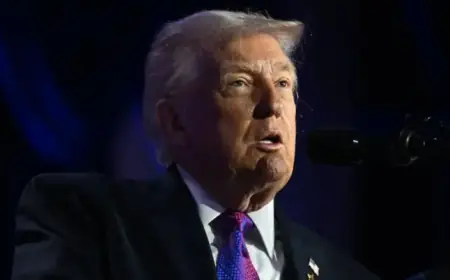

Oil prices are experiencing an upward trend, rising by 1% early on Wednesday. This increase comes amid escalating tensions between the U.S. and Iran. Additionally, Israeli Prime Minister Benjamin Netanyahu is scheduled to meet with U.S. President Donald Trump, adding further complexity to the situation.

Current Oil Prices

In European morning trade on Wednesday, the U.S. West Texas Intermediate (WTI) Crude rose by 1.39%, reaching $64.85 per barrel. Meanwhile, the international benchmark, Brent Crude, approached the $70 mark, increasing by 1.29% to $69.69.

Impact of Geopolitical Tensions

The ongoing U.S.-Iran tensions have been pivotal in shaping market perceptions this week. The oil market continues to assess the potential for negotiations between the U.S. and Iran. Before heading to Washington, Netanyahu stated, “I will present to the president our outlook regarding the principles of these negotiations.”

- Netanyahu aims for a deal to halt Iranian uranium enrichment.

- Israel seeks to limit Iran’s support for groups like Hamas and Hezbollah.

- Discussions may also include curbing ballistic missile development.

According to Netanyahu’s office, these key points will be part of the agenda in his discussions with President Trump. Additionally, Trump has indicated that the U.S. might deploy a second aircraft carrier to the region if negotiations are unsuccessful.

Market Reactions to Inventory Reports

Despite the surge in prices this week, oil prices faced volatility after the American Petroleum Institute (API) reported a significant increase in U.S. crude oil inventories. The API estimated an increase of 13.4 million barrels for the week ending February 6. This figure overshadowed the previous week’s drawdown of 11.1 million barrels.

Furthermore, reports about the U.S. contemplating the seizure of sanctioned Iranian oil tankers have contributed to rising prices. However, such an action could escalate tensions, prompting analysts like Warren Patterson and Ewa Manthey from ING to warn of a potential increase in risk premiums due to Iranian retaliation concerns.

In summary, the current rise in U.S. oil prices is significantly influenced by geopolitical developments and market responses to inventory changes. As the situation evolves, traders will closely monitor both diplomatic efforts and inventory reports.