Budget Office Warns: Federal Debt Set to Reach Historic Heights

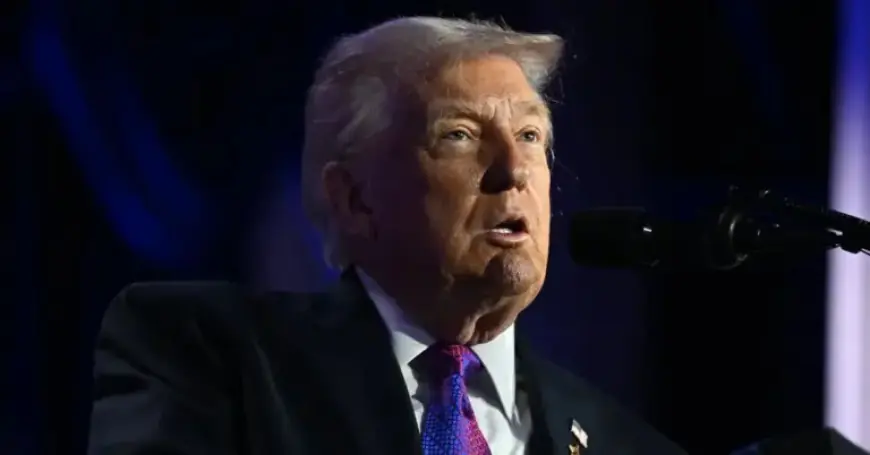

The Congressional Budget Office (CBO) has issued a stark warning regarding the country’s financial future, projecting that the federal debt is set to reach historic heights. The report highlights the effects of various economic policies implemented in recent years, particularly under the administration of President Trump.

Federal Debt Projection

According to the CBO, the federal government is anticipated to face a staggering shortfall of $23.1 trillion over the next nine years. This figure marks an increase from earlier projections of a $21.8 trillion deficit, demonstrating a $1.4 trillion wider gap.

Debt vs. Economic Output

The CBO forecasts that by 2036, public debt will exceed 120% of the nation’s gross domestic product (GDP). This unprecedented level of debt would surpass the figures seen after World War II and raises concerns about a potential destabilizing debt crisis that could affect the global economy.

Factors Influencing the Budget

- Tax Cuts: The recent income tax cuts are expected to cost approximately $4.7 trillion over the next nine years, benefitting wealthier individuals while reducing spending on programs for lower-income citizens.

- Tariffs: Trump’s tariffs are projected to generate around $3 trillion in revenue during the same timeframe. However, uncertainty about their longevity and legal challenges continues to loom.

- Social Security: The funding for Social Security is projected to run out by 2032, compelling Congress to explore new financing options to prevent drastic benefit cuts.

- Demographic Changes: A reduction in population growth, estimated at 5.3 million fewer people by 2035, may lead to decreased tax revenues, resulting in an overall budget impact of about $500 billion.

Long-term Economic Implications

The risks associated with increasing federal debt extend to investor confidence. As the market reacts, doubts about the government’s ability to repay its obligations could lead to elevated interest rates, which would further exacerbate the borrowing crisis.

The CBO highlights that while President Trump’s tax cuts may provide a temporary boost to the economy, they are also likely to result in higher long-term interest rates than previously expected. This complex interplay of policy outcomes poses significant challenges for the U.S. financial landscape.

As we move forward, policymakers will need to address the urgent questions surrounding federal budgeting and debt management to safeguard the nation’s economic stability.