Kraft Heinz Halts Split, New CEO Confirms Issues Are Fixable

Kraft Heinz has officially halted its plans to split the company into two segments. This decision was announced by the new CEO, Steve Cahillane, in light of challenging conditions within the food industry. Cahillane emphasized that despite these challenges, the issues facing the company are manageable and within their control.

Kraft Heinz’s Shift in Strategy

Initially, Kraft Heinz had intended to separate its operations into two distinct entities focusing on groceries and sauces. This announcement came in September and aimed to revitalize the business, which has struggled to maintain growth since its merger over a decade ago involving Berkshire Hathaway and 3G Capital.

Current Landscape and Challenges

In recent times, Kraft Heinz has experienced significant competition, losing market share to rivals who offer healthier and more affordable options. Cahillane noted that a series of price increases led to consumer disappointment, as many turned away from the brand in favor of cheaper alternatives.

- Price Hikes: Recent price increases alienated consumers.

- Market Positioning: Kraft Heinz has lagged behind its competitors over the past five years.

Future Plans and Investments

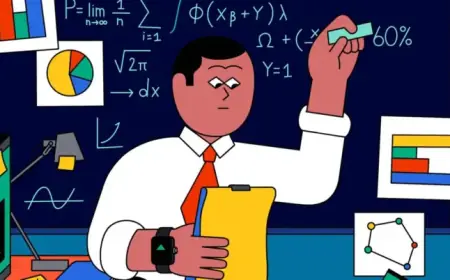

To reverse the downward trend, Cahillane has outlined a comprehensive investment strategy. The company plans to allocate an additional $600 million to marketing, research, and development. This reinvestment is programmed for 2026, with hopes of stabilizing the U.S. market where conditions have significantly worsened.

According to Cahillane, there will be a 20% increase in R&D investments compared to 2025. This move is part of a broader initiative to enhance product innovation while focusing on nutrition and value. Notably, Kraft Heinz aims to provide consumers with greater benefits for any price increases it may implement.

Financial Outlook and Earnings Forecast

Kraft Heinz’s recent quarterly results were disappointing, showing that earnings fell short of analyst expectations. For 2026, the company anticipates organic net sales to decline between 1.5% and 3.5%. Expected annual profits are projected to be between $1.98 and $2.10 per share, which is below the $2.49 target set by analysts.

- Expected Earnings: $1.98 to $2.10 per share for 2026.

- Sales Decline: Projected sales decline of 1.5% to 3.5%.

Market Reaction

The announcement regarding the halted split has resulted in minimal changes to Kraft Heinz’s share price, which had previously fallen by 5%. The broader implications of this pause indicate complications that may have been underestimated by the company.

Industry analysts suggest that the decision to postpone the separation reflects deeper operational challenges within the company. Plans for substantial reinvestment have been met with cautious optimism from the market, as many recognize the necessity of these changes amid fierce competition.

Cahillane has not ruled out a future separation but has stated that there is currently no timeline to revisit this goal. The move to pause the split is projected to generate $300 million in savings by 2026, focusing resources on fixing internal issues rather than pursuing a potentially flawed separation.

As Kraft Heinz navigates these tumultuous waters, all eyes will be on how effectively the company can pivot its strategies to regain consumer trust and improve its market position.