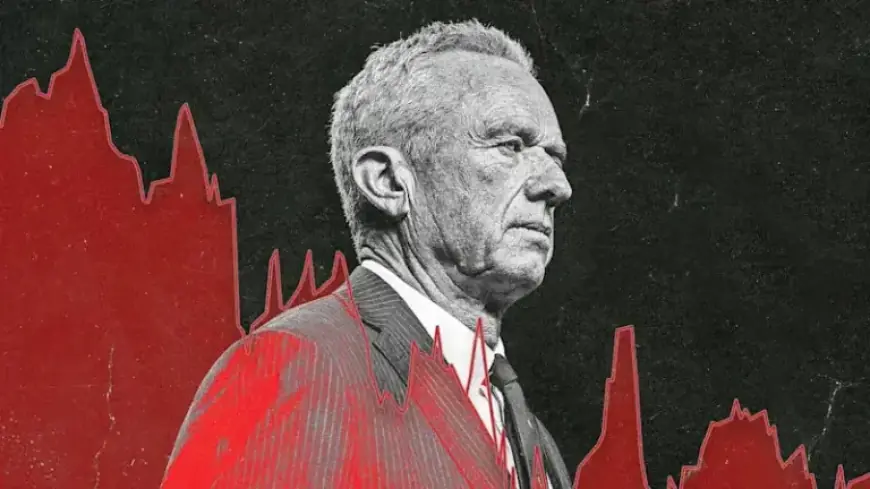

RFK Jr’s Policies Result in $10 Billion Loss for Major Australian Firm

In a significant development for the biotechnology industry, CSL Limited, one of Australia’s largest firms, has reported devastating financial losses. The company’s latest figures reveal a $1.5 billion writedown linked to US regulatory changes. These adjustments stem from the policies implemented by US Health Secretary Robert F. Kennedy Jr., who has faced criticism for his stance on vaccines.

Impact of Kennedy’s Policies on CSL

CSL’s valuation plummeted by $10 billion following the announcement of these writedowns. The revelation, made public on February 11, 2026, resulted in an 81% decline in the company’s first-half profits. The corporate upheaval intensified after a sudden change in leadership, with interim CEO Gordon Naylor stepping in to steer the company during this turbulent time.

Financial Performance and Challenges

- Net profit after tax fell to $401 million (approximately $566 million) for December half-year.

- Asset writedowns totaled $1.1 billion, affecting multiple segments of its global operations.

- CSL’s share price halved over 18 months, resulting in a loss exceeding $70 billion in shareholder wealth.

- Shares dropped by as much as 12% to $150.23 following the news of leadership changes.

These results are indicative of a broader transformation strategy within CSL. Naylor, emphasizing his commitment, stated that he aims to enhance growth, profitability, and returns for shareholders. His stance is particularly critical in the face of recent declines in US vaccination rates, which have impacted the company’s vaccine division significantly.

Broader Implications of US Vaccine Market Changes

The changes in the US vaccine market, particularly under Kennedy’s administration, have created a challenging environment for CSL. The company’s troubles were compounded by regulations that have made it more difficult to operate profitably in the US, along with President Donald Trump’s threats of imposing hefty tariffs on pharmaceuticals.

International Challenges

CSL has also faced challenges from changing regulations in international markets. In particular, revised rules in China now allow for a plant-based version of albumin, a critical blood plasma product, to compete with CSL’s human-derived version. This led to a 27% drop in exports to the Chinese market.

Leadership and Future Outlook

The board faced considerable pressure regarding the company’s direction. Chairman Dr. Brian McNamee indicated a crucial shift was necessary, suggesting that former CEO Paul McKenzie was not equipped to meet the evolving demands of the business.

As CSL navigates this challenging landscape, all eyes will be on how effectively the leadership transition can revitalize the firm. The impact of Kennedy’s policies, along with company strategies, will be crucial in shaping CSL’s future.