China Intensifies Crypto Crackdown, Vetting Real-World Asset Tokens

China is intensifying its crackdown on cryptocurrencies while aiming to establish a regulatory framework for real-world asset (RWA) tokenization. The country has explicitly banned the unauthorized offshore issuance of yuan-backed stablecoins, marking a stringent move by its central bank.

Key Developments in China’s Crypto Regulations

- Date: February 6, 2023

- Location: Beijing, China

- Authority: People’s Bank of China and seven other agencies

The recent measures reiterate China’s longstanding prohibition on virtual currencies. Most notably, the central bank is emphasizing that only its own digital yuan is recognized as legitimate. Winston Ma, an adjunct professor at NYU School of Law, highlighted the importance of this distinction, stating that a myriad of private yuan stablecoins will not be accepted.

Challenges Posed by Speculative Activities

Chinese authorities have identified recent speculative activities involving cryptocurrencies as an emerging concern that necessitates stricter enforcement. In a joint statement, they declared that virtual currencies lack legal standing akin to fiat currencies. Consequently, actions related to them are classified as illegal financial activities.

Domestic and controlled overseas entities are barred from issuing virtual currencies outside of China without official permission. Furthermore, both domestic and foreign bodies are restricted from creating offshore stablecoins pegged to the yuan without authorization.

RWA Tokenization: A Controversial Step Forward

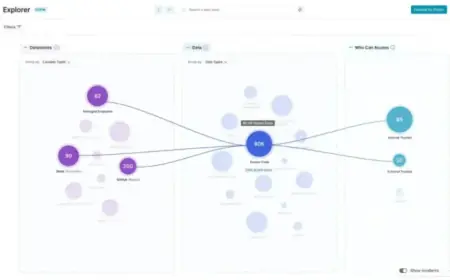

Despite the crackdown, there appears to be a cautious opening for RWA tokenization. Recent announcements indicate that offshore tokens backed by Chinese onshore assets will be subject to regulatory scrutiny, signaling a potential move toward legalization within this sector.

- Quote from Louis Wan: “The biggest breakthrough is a clear separation between virtual currencies and RWA.”

- Insight from Alex Zuo: “This means China is allowing the issuance of offshore tokens based on onshore assets.”

The initiative to regulate RWA tokenization is viewed as a significant milestone, with industry experts suggesting that it could lead to a more structured environment for the digital asset market in China. As developments unfold, stakeholders are hopeful for clear guidelines that will govern this emerging landscape.

The tightening of regulations also extends to financial institutions, which are cautioned against offering banking and clearing services for businesses involved with virtual currencies. This comprehensive strategy illustrates China’s commitment to reinforcing its digital economy under strict government oversight.