Wall Street Tensions Escalate: D-Day Alarm Bells Intensify

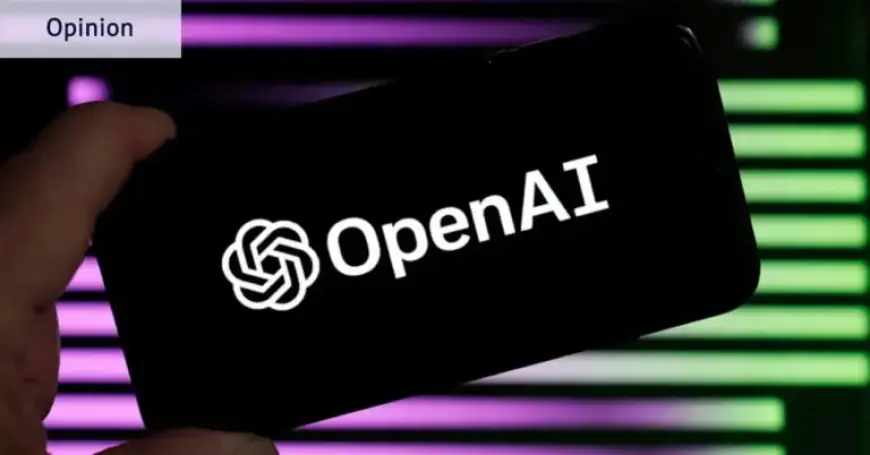

Recent developments on Wall Street indicate rising tensions as D-Day alarm bells sound for the investment community. The release of new tools by Anthropic for its Claude AI chatbot has sparked widespread concern, leading to a tumultuous week for tech stocks.

AI Disruption and Market Reactions

OpenAI’s ChatGPT faced significant competition for the first time since its inception over three years ago. The introduction of Anthropic’s automation tools is viewed as a serious threat to various industries, particularly software and service sectors.

As a result, stocks in these vulnerable sectors saw a steep decline. Investors are now grappling with the potential ramifications of AI disrupting established economic models. The market cap of major tech companies dropped nearly $800 billion after Amazon announced an expected $200 billion in capital expenditures for the year, largely focused on AI.

Capital Expenditure Trends

Spending trends in the AI sector are staggering:

- Amazon: $200 billion in 2026

- Alphabet (Google’s parent): $185 billion

- Meta: $135 billion

- Microsoft: $100 billion+

- Oracle: $50 billion

This will lead to a total of over $670 billion in capital expenditures by major tech companies, significantly impacting the U.S. economy, amounting to more than 2% of the GDP.

The Implications for Investors

As AI technology matures, investors are becoming increasingly cautious. Previously viewed as solely a transformative technology, AI adoption is now seen through a dual lens of opportunity and risk. The potential for substantial returns is juxtaposed with uncertainty regarding which companies will succeed.

Debt markets are tightening, and there are growing concerns about the sustainability of current expenditure levels. Companies heavily invested in AI must grapple with rising costs, slower return on investment, and challenges in securing necessary capital.

Cost Challenges and Infrastructure Strain

The scramble to construct data centers is already inflating construction costs and impacting electricity prices. The growing demand for energy and water to support these facilities is approaching supply limits, highlighting the need for efficient resource management.

Given these compounding challenges, consolidation within the AI sector appears necessary. The focus will likely shift towards viability over sheer ambition, scrutinizing existing business models and their resilience against AI disruption.

Conclusion

As Wall Street faces these critical moments, the outlook for AI investments remains uncertain. With alarm bells sounding, a more discerning approach is essential for both investors and businesses. This pivotal year might redefine the investment landscape as stakeholders assess the sustainability of their AI strategies.