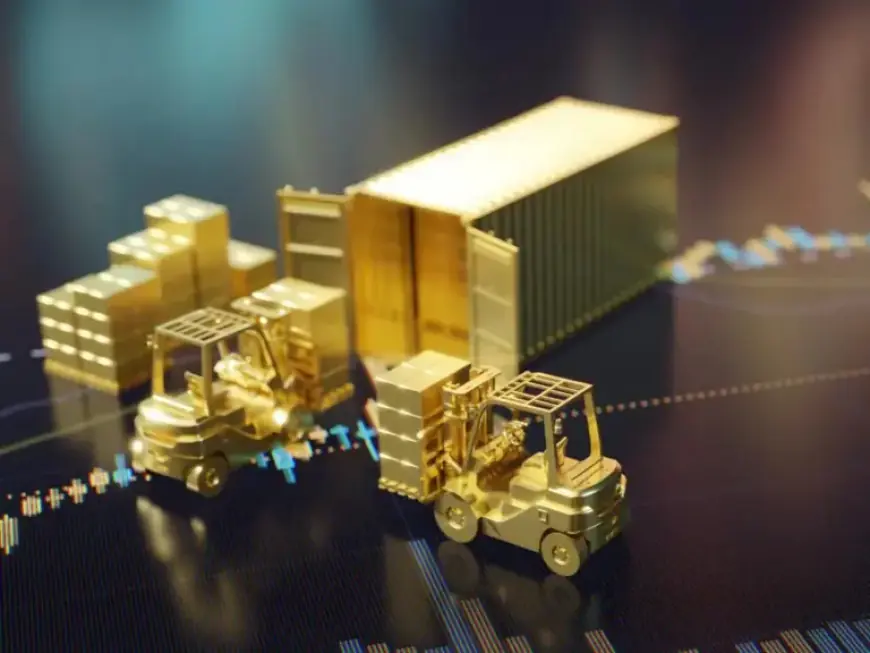

Wealthy Australians Abandon Industry Super for Better Investment Options

Wealthy Australians are increasingly moving away from industry superannuation funds to seek better investment alternatives. This trend reflects a growing desire for more lucrative returns on their retirement savings.

Reasons for the Shift

High net-worth Australians are dissatisfied with the performance of traditional industry superannuation plans. Many are exploring new investment options that promise higher yields.

- Desire for better returns

- Dissatisfaction with traditional superannuation performance

- Interest in diversified investment strategies

Investment Alternatives

Several investment categories are attracting wealthy individuals:

- Real estate

- Equity investments

- Private equity funds

- Cryptocurrencies

Impact on the Superannuation Industry

This shift poses challenges for the industry superannuation sector. As more affluent clients withdraw, funds may experience a decline in membership and capital.

Future Expectations

Industry experts predict that the trend will continue. Focus will likely shift towards offering tailored financial solutions to retain high net-worth clients.

In conclusion, the move of wealthy Australians away from industry superannuation marks a significant change in retirement planning. It highlights the need for innovation in investment opportunities.