Home Battery Installations Drop as Installers Pause After Rebate Launch

A recent analysis has shown a significant decline in home battery installations in Australia during January 2026. This decrease marks the first contraction since the introduction of the Cheaper Home Batteries rebate in July 2025. According to industry data from SunWiz, small-scale battery registrations totaled 983 megawatt-hours, a drop from nearly 1.2 gigawatt-hours in December 2025.

Reasons for the Decline in Home Battery Installations

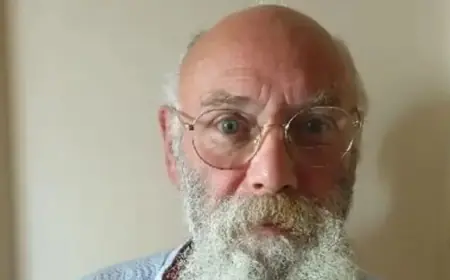

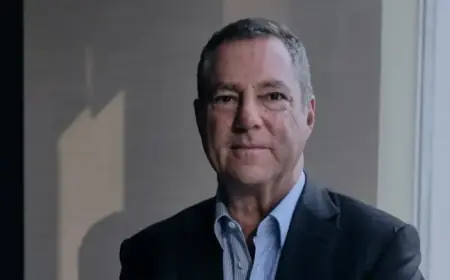

Warwick Johnston, managing director of SunWiz, attributes the 17 percent decrease to installers taking a break over the summer holidays. This pause is not seen as a reduction in demand for home battery systems. In fact, the Clean Energy Council recently confirmed that the federal battery rebate has spurred significant consumer interest.

Despite the decline in January, the market remains optimistic. Changes to the rebate program are set to launch in May, which could influence future demand.

State-by-State Market Performance

- Victoria reported a small increase of 3 percent in battery registrations.

- Every other state experienced declines exceeding 20 percent.

The overall registrations for January 2026 fell below the 1 gigawatt-hour threshold but Johnston emphasizes that the market remains robust. The average size of installed battery systems has risen to 35.64 kWh, indicating that households are opting for larger systems even amidst the decline in total registrations.

Rooftop Solar Installations Also Decline

Rooftop solar installations followed a similar downward trend with a total of 244 megawatts registered in January, representing a 32 percent decrease from December’s figures. This is consistent with typical seasonal patterns, as January generally shows a slowdown in installations.

Commercial vs. Residential Installations

- Commercial solar installations in the 50-70 kW market segment faced the steepest decline at 57 percent.

- Residential installations dropped by 24 percent month on month.

While these statistics show a notable decrease, they mirror January trends from previous years, suggesting that seasonal factors play a critical role in these fluctuations. Overall, the home battery and solar market appears poised for recovery as demand remains strong, particularly with the anticipated changes to rebate policies on the horizon.