Wall Street Decline Intensifies; ASX Expected to Drop

U.S. sharemarkets have faced notable declines for two consecutive sessions. Investors continue to retreat from crowded trades in technology and digital assets, leading to significant market shifts.

Market Performance Overview

The major U.S. indices recorded the following changes:

- Dow Jones Industrial Average: Down 1.2% (approx. 593 points) to 48,908

- S&P 500: Decreased by 1.23% to 6,798, slipping into negative territory for the year

- Nasdaq Composite: Fell 1.59% to 22,541

Losses were driven primarily by declines in technology stocks. This sector faced renewed pressure amid ongoing discussions regarding artificial intelligence (AI) spending.

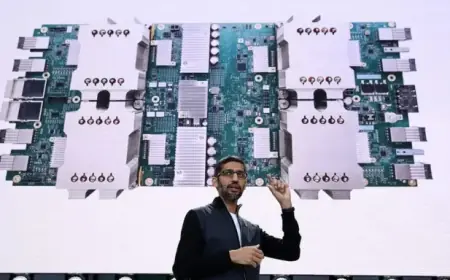

Technology Sector Under Pressure

Major players in technology are grappling with mixed forecasts. Alphabet anticipates an increase in AI investment, projecting up to $185 billion in capital expenditure by 2026. This announcement negatively impacted its stock prices.

In contrast, Broadcom saw a rally of nearly 1% as investors assessed potential beneficiaries from strong AI spending. Meanwhile, Qualcomm fell over 8%, following a weakened outlook attributed to a global memory shortage.

Crypto and Commodities Decline

The sell-off in cryptocurrencies and commodities is intensifying. Bitcoin has dropped below $64,000, marking a retreat after exceeding $70,000 earlier in the week.

Precious metals also suffered, with silver plummeting nearly 16% in a single session, following a substantial 30% drop the week prior. These fluctuations highlight the forced selling experienced in highly leveraged markets.

Labor Market Concerns

Recent U.S. labor market indicators point to a deteriorating economic outlook. Layoff announcements for January reached their highest levels for the month since the global financial crisis.

Initial jobless claims have been higher than anticipated, and job openings have hit their lowest level since September 2020. Market participants are now attentive to the delayed January jobs report from the Bureau of Labor Statistics, as expectations for a mid-year rate cut from the Federal Reserve grow.

Australian Market Outlook

Anticipations for the Australian market suggest a weaker opening, mirroring extended losses in New York. ASX 200 futures are down by 98 points, or 1.1%, indicating a preliminary level around 8,752.

Domestically, investor focus will be directed towards Michele Bullock’s testimony. Additionally, company earnings results from News Corp, REA Group, and Charter Hall Retail REIT are anticipated.

In the United States, post-market earnings from Amazon and Atlassian are expected to set the stage for upcoming sessions.