Australia’s ‘Bargain Bin’ Property Market Transforms Beyond Recognition

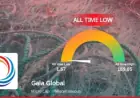

Brisbane’s property market has undergone a remarkable transformation in recent years, shedding its image as the “bargain bin” of Australia’s capital cities. Over the past five years, the median house price surged from approximately $600,000 in September 2020 to over $1.1 million by September 2025. This escalation made Brisbane the second most expensive capital city, trailing only behind Sydney.

Staggering Price Increases

The unit prices mirrored this growth, increasing from around $414,000 to more than $715,000 within the same timeframe. The price hikes were particularly notable in suburbs previously overlooked, where increases exceeded 130 percent.

Key Statistics

- Median house price in September 2020: $600,000

- Median house price in September 2025: $1.1 million

- Unit median price increase: from $414,000 to $715,000

- Woodridge house prices surged: 203.4% to $607,500

- Eagleby unit prices rose: 144.5% to $710,000

- Moggill house prices climbed: 101.7% to $1.1 million

- Cannon Hill prices jumped: 97.7% to $1.6 million

Market Dynamics

The property surge became evident when Brisbane achieved a $1 million median house price in September 2024. In the year preceding this milestone, prices increased by nearly $135,000, marking one of the steepest annual rises on record. Despite rising affordability concerns, demand continued to escalate, even pushing Brisbane ahead of Melbourne as the second most expensive capital city just three months later.

As housing in prime locations became less accessible, buyers sought opportunities in outer suburbs once stigmatized by housing commissions. Affordability pressures redirected the market toward these areas. The remaining affordable neighborhoods not only vanished, but they also displayed some of the most substantial price growth in the region.

Changing Demographics

Market observers noted a demographic shift with an influx of younger buyers. Areas like Woodridge and Eagleby became more attractive due to their transport connections and proximity to essential services. The COVID-19 pandemic fueled this trend as buyers favored relaxed lifestyles within commuting distance to the city.

First-home buyers now find themselves navigating a market where the average spending has approached $1 million. The inflation of property values is reshaping perceptions of affordability, leading to evolving expectations among buyers.

Future Outlook

Though price growth has moderated recently, experts believe Brisbane’s momentum is likely to persist. Population growth, infrastructure development, and an ongoing housing shortage are critical factors maintaining demand in the real estate market.

With the vibrant lifestyle, quality schooling, and accessibility to rivers driving interest, Brisbane remains a focal point for property investors. As noted by local agents, the potential for further price hikes remains significant as more buyers become aware of the opportunities present in Brisbane’s evolving neighborhoods.