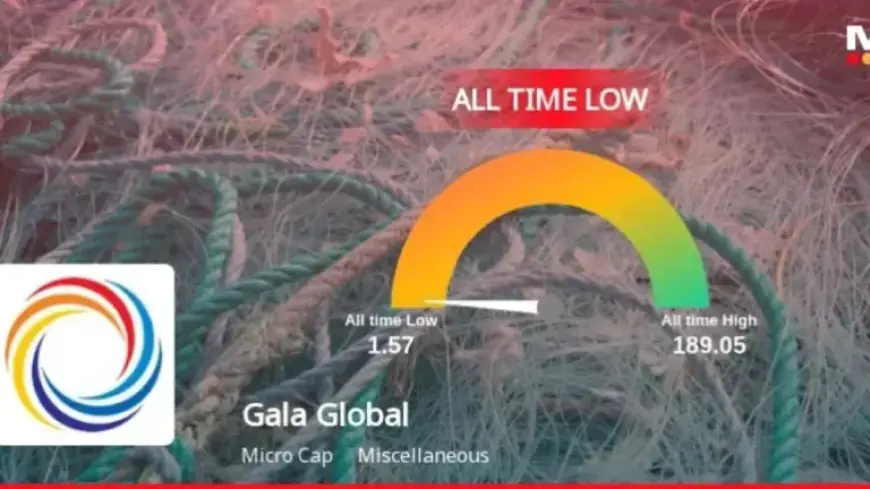

Gala Global Products Stock Hits Record Low Amid Continued Downtrend

Gala Global Products Ltd’s stock has reached unprecedented lows, reflecting ongoing market struggles. Investors and analysts express growing concerns about the company’s financial stability and profitability.

Recent Stock Performance

On February 6, 2026, Gala Global’s stock declined by 2.53%, underperforming the Sensex, which fell only 0.39%. The trends over recent periods indicate significant losses:

- Weekly decline: 7.23% vs. Sensex gain of 0.87%

- Monthly decline: 21.43%

- Three-month decline: 40.08% vs. Sensex decline of 0.39%

- Year-to-date loss: 23.00% vs. broader market decline of 2.62%

- Annual decrease: 58.49% while the Sensex gained 6.31%

- Three-year decline: 82.66% vs. Sensex gain of 37.15%

- Five-year decline: 95.14% vs. Sensex gain of 63.58%

Financial Health and Profitability Issues

The underlying financial data for Gala Global Products Ltd points to a series of challenges:

- Consecutive operating losses highlight ongoing business weaknesses.

- Debt to EBITDA ratio is at a concerning 13.56, indicating high leverage.

- Return on Equity (ROE) stands at just 1.90%.

- Profit Before Tax excluding other income (PBT LESS OI) is recorded at -₹0.26 crore, reflecting a decline of 111.26%.

- Net sales over the last six months dropped by 35.82% to ₹9.80 crore.

- Profit After Tax (PAT) for the same period is -₹2.33 crore, also down 35.82%.

These indicators underscore the company’s severe revenue decline and persistent losses.

Valuation and Risks

Gala Global’s current market valuation appears undervalued relative to its historical performance. Notably:

- Despite a 58.49% loss in share price, profits worsened by about 985%.

- Consistent underperformance against benchmark indices like BSE500 reflects ongoing recovery challenges.

- A majority of shares being held by non-institutional investors impacts overall liquidity.

Market Ratings Overview

As of April 7, 2025, Gala Global’s Mojo Grade was downgraded from Sell to Strong Sell due to negative market sentiment and deteriorating fundamentals. Current scores are:

- Mojo Score: 3.0 (indicating Strong Sell)

- Market Cap Grade: 4 (showing modest capitalization in its sector)

The stock is trading near its 52-week low, highlighting significant challenges within the miscellaneous industry sector.

Conclusion

The drop in Gala Global Products Ltd’s stock price marks an ongoing struggle for financial stability and market performance. Weak profitability, high leverage, and declining sales cast doubt on its operational sustainability. Investors should remain vigilant as developments in the broader market unfold.