Microsoft Loses Major Supporter Following Alphabet’s Earnings Report

Following Alphabet’s recent earnings report, Microsoft faced a significant setback from a key analyst. Alphabet, the parent company of Google, demonstrated impressive growth in its cloud services, which led to a reevaluation of Microsoft’s stock potential.

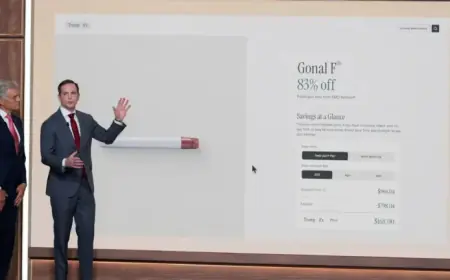

Analyst Downgrades Microsoft

On February 5, 2026, Brad Reback, an analyst at Stifel, announced a downgrade of Microsoft (MSFT) from a buy to a hold. This shift reflects growing concerns about the tech giant’s immediate growth prospects.

Reasons for Downgrade

- Alphabet’s robust earnings highlighted its strength in the cloud sector.

- Reback identified a lack of near-term catalysts for Microsoft.

- The downgrade indicates potential challenges ahead for Microsoft investors.

Investors may need to reassess their positions in Microsoft as Alphabet continues to strengthen its footprint in the competitive cloud market. This development emphasizes the dynamic nature of the tech industry and the growing influence of cloud services on stock performance.