Monetary Policy Decisions Impact Global Markets

On February 5, 2026, the European Central Bank (ECB) held a pivotal meeting where the Governing Council announced that it would maintain the interest rates across its key financial facilities. This decision reflects a thorough analysis of the current economic landscape and inflation outlook.

Monetary Policy Decisions and Interest Rates

The Governing Council decided to keep the following rates unchanged:

- Deposit Facility: 2.00%

- Main Refinancing Operations: 2.15%

- Marginal Lending Facility: 2.40%

According to the council’s latest assessment, inflation is projected to stabilize at the targeted rate of 2% in the medium term. This forecast comes amid ongoing challenges in the global market.

Economic Resilience Amid Challenges

The current economic environment displays resiliency, supported by:

- Low unemployment rates

- Robust private sector balance sheets

- Gradual increases in public spending, particularly in defense and infrastructure

- Positive impacts from previous interest rate cuts

Despite these strengths, uncertainties persist due to fluctuating global trade policies and geopolitical tensions.

Data-Driven Approach to Monetary Policy

The Governing Council emphasizes a data-driven strategy. Decisions regarding interest rates will hinge on economic data and inflation risk assessments. The council is committed to adjusting its monetary policy tools as needed to ensure price stability.

Notably, the council has clarified that it is not committed to a specific interest rate trajectory. This flexible approach aims to adapt to changing economic conditions.

Asset Purchase Programme and Market Stability

The ECB’s Asset Purchase Programme (APP) and Pandemic Emergency Purchase Programme (PEPP) are being phased out gradually. The Eurosystem no longer reinvests principal payments from maturing securities, reflecting a shift in financial strategy.

Furthermore, the Transmission Protection Instrument is poised to address any disruption in monetary policy transmission across eurozone countries, ensuring market stability.

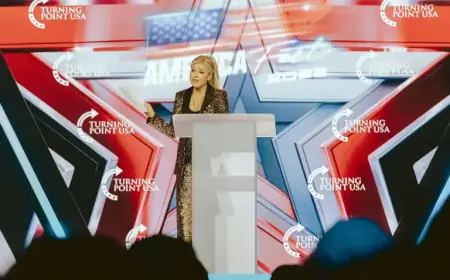

Following this announcement, the President of the ECB will provide further insights during a press conference scheduled for 14:45 CET today.