Trump’s Appointee May Trigger Financial Crisis

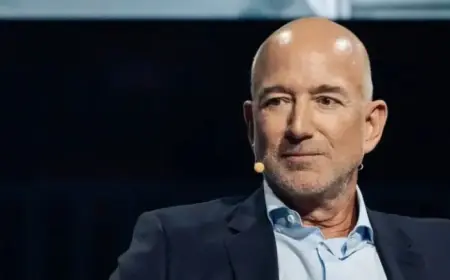

Kevin Warsh, recently nominated by President Donald Trump to lead the U.S. Federal Reserve Board, intends to reduce the Fed’s balance sheet significantly. Warsh argues that a smaller balance sheet can foster higher economic growth and lower inflation. He believes that the Fed’s previous balance sheet expansion, primarily through money printing, has inflated the financial system without enhancing real economic growth.

Background on Kevin Warsh

Kevin Warsh served on the Federal Reserve Board during its initial quantitative easing (QE) phase that started in response to the 2008 financial crisis. Since leaving the board in 2011, he has voiced criticism against QE. He contends that an oversized balance sheet depresses U.S. interest rates and promotes excessive government spending.

Current Economic Context

The U.S. government currently faces a staggering $38 trillion debt. Warsh, who was involved in the Fed’s early QE practices, now seeks to pivot toward what he believes is a more sustainable monetary policy.

Impact of Quantitative Easing

QE expanded the Fed’s balance sheet from around $900 billion to over $4 trillion. This escalation continued through a much more extensive QE suite during the pandemic, leading to an almost $9 trillion balance sheet. In mid-2022, the Fed began a policy of quantitative tightening (QT) to allow bonds to mature without reinvesting proceeds. As a result, the balance sheet has shrunk to approximately $6.6 trillion.

Reserves and Their Role

The Fed’s current reserves, primarily made up of bank deposits, represent high-quality assets essential for liquidity management. However, the components of the Fed’s balance sheet that cannot be reduced include:

- U.S. currency in circulation: approximately $2.4 trillion

- The U.S. Treasury account: about $900 billion

- Reserves: core assets focused for potential reduction by Warsh

Risks of Shrinking the Balance Sheet

Warsh’s strategy to decrease the Fed’s influence in the financial system could introduce risks. It might lead to instability in both U.S. and global markets. Historically, excessive tightening of the balance sheet has been associated with financial turmoil.

Historical Precedents

In 2019, a liquidity crisis erupted in the repo market, leading to a spike in borrowing costs. The Federal Reserve intervened with liquidity injections of $110 billion to stabilize conditions. There are concerns that similar conditions might arise again, particularly given the Fed’s recent actions to purchase Treasury bills at a rate of $40 billion a month.

The Road Ahead

Warsh is confident that the U.S. economy can grow more robustly, driven by technological advancements such as artificial intelligence. However, there are uncertainties surrounding the timeline and impact of these changes.

In conclusion, while Warsh’s intentions to shrink the Fed’s balance sheet aim to encourage market-driven economics, they could inadvertently increase market volatility. The delicate balance between ensuring liquidity and reducing the Fed’s footprint poses significant challenges for future monetary policy.