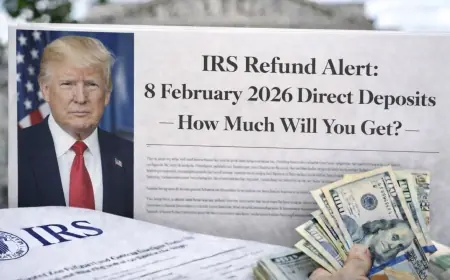

IRS Refund Status Today: How to Track “Where’s My Refund” in 2026, When Refunds Hit, and What the Shutdown Could Change

Tax season is underway, and “where’s my refund” searches are spiking for one reason: people want a date, not a process. In 2026, the process matters more than usual because the filing season opened on January 26, 2026, ET, at the same time Washington is dealing with a partial federal shutdown that could reshape customer service and backlogs even if refunds keep moving.

The practical headline for most filers is this: if you e-filed and chose direct deposit, many refunds still arrive within about 21 days of acceptance, but timelines widen quickly if your return needs review, you claimed certain credits, you filed on paper, or you did not provide banking information.

When the IRS started accepting tax returns in 2026

The IRS began accepting and processing individual federal income tax returns for the 2025 tax year on Monday, January 26, 2026, ET. That date matters because the refund clock generally starts after a return is accepted, not when you hit “submit” in your software.

How the IRS refund tracker works in 2026

The official “Where’s My Refund” tracker is built around a simple idea: the IRS posts status updates in batches, not continuously.

What to know when you check:

-

First status usually appears about 24 hours after an electronically filed return is accepted.

-

Paper returns can take about four weeks before they even show up as received.

-

Updates happen once daily, overnight, and the tool is often unavailable around 4 a.m. to 5 a.m. ET while the system refreshes.

-

You typically need three pieces of info: your Social Security number or ITIN, filing status, and exact refund amount.

If your status doesn’t change for several days, that does not automatically mean a problem. During high-volume weeks, “received” can sit for a while before it flips to “approved.”

How long refunds take, and why “21 days” isn’t a guarantee

For many taxpayers, the fastest path is still:

-

E-file + direct deposit

That combination often produces a refund in about three weeks, but several things can extend the timeline:

-

Identity verification or fraud filters

-

Math errors or mismatched income documents

-

Returns flagged for manual review

-

Paper filing

-

Choosing a mailed check or not providing bank details

There is also a big calendar caveat: refunds tied to certain refundable credits often cannot be issued until later in February by law, even if your return is accepted early. That’s why many early filers see their status “stuck” and then suddenly move.

What the partial government shutdown means for IRS refunds

A partial shutdown is underway as of Monday, February 2, 2026, ET, and taxpayers are right to ask whether it affects refunds.

Here’s the reality: refund processing is heavily automated, and the IRS has historically tried to keep refund operations moving even during funding disruptions. But shutdown conditions can still change the experience in three ways:

-

Customer support can thin out, making it harder to reach help if your return needs human intervention.

-

Manual reviews can slow, which disproportionately affects returns flagged for verification, corrections, or missing documentation.

-

Backlogs compound quickly: even a short disruption can create a wave that takes weeks to unwind.

So the shutdown is less likely to halt refunds across the board and more likely to create a two-track system: straightforward returns move; anything that requires a person takes longer.

Behind the headline: why refunds feel more stressful this year

Context: Refunds aren’t just a government payment; for many households they are a budgeting event. Rent, credit cards, car repairs, and catching up after holiday spending often depend on that deposit.

Incentives: The IRS wants rapid, fraud-resistant payouts. Lawmakers want both enforcement and speed, but they also use agency funding fights to push policy goals. Tax prep companies want smooth filing volumes and fewer panic calls.

Stakeholders who feel delays first:

-

Low- and moderate-income households waiting on refundable credits

-

Contractors and gig workers with more complex returns

-

People filing on paper

-

Anyone who changed banks, moved, or has identity verification issues

-

Tax preparers, including firms like Jackson Hewitt, dealing with higher “where is it” support demand

Missing pieces: The key unknown is not whether refunds exist, but how many returns will be routed into manual handling and whether shutdown turbulence expands that pile.

What to do right now if you’re tracking a refund

-

Double-check that your return was accepted, not just submitted.

-

If you chose direct deposit, confirm the routing and account numbers are correct.

-

If you claimed refundable credits, expect the refund to arrive later than basic “21-day” expectations.

-

If the tracker shows a request for more information, respond quickly; delays compound.

-

Avoid planning a bill payment around a specific date unless you already have an approved status with a deposit date.

What happens next: realistic scenarios and triggers

-

Fast normalization

Trigger: Congress ends the shutdown quickly and the IRS maintains normal staffing for reviews. -

Two-speed season

Trigger: refunds remain steady for simple e-filed returns, while reviewed returns slow noticeably. -

A visible mid-February crunch

Trigger: high volumes plus credit-related timing rules push many refunds into a narrow release window, stressing systems and support lines. -

Longer delays for paper and non-bank refunds

Trigger: processing and payment policy shifts keep pushing taxpayers toward direct deposit, leaving paper-based paths slower.

If you want a quick gut check: if you e-filed, used direct deposit, and your return is uncomplicated, you’re in the best lane. If anything about your return requires a human touch, the combination of peak-season volume and shutdown uncertainty makes patience, accuracy, and quick follow-ups more important than ever.