IRS Where’s My Refund 2026: Refund Tracker Status, Update Times, and When Your Deposit Might Arrive

If you’re checking “IRS refund” or “Where’s My Refund” today, you’re not alone. The filing season is now fully underway, and the refund system tends to feel slowest right when the volume is highest and anxiety is sharpest. The good news is that most refund timelines are predictable once you know two things: when your return was accepted and whether anything about it requires a human review.

For 2026, the IRS opened the filing season and began accepting and processing federal individual income tax returns on Monday, January 26, 2026, ET. That acceptance date is the starting gun for most refund expectations.

IRS Where’s My Refund: how the refund tracker updates

The refund tracker is not a live feed. It updates in batches, which is why repeated checks during the day usually show the same result.

Here’s how it typically behaves in 2026:

-

Your status often appears about 24 hours after an electronically filed current-year return is accepted.

-

Paper returns can take about four weeks to show up as received.

-

The tracker updates once per day, overnight, and is generally unavailable each morning between 4 a.m. and 5 a.m. ET while updates run.

Most people see a simple progression:

-

Received

-

Approved

-

Sent

Once it shows Approved, the remaining wait is usually about banking and settlement timing, not additional processing.

When your IRS refund might arrive in 2026

A lot of filers hear “within 21 days” and treat it like a promise. It’s better understood as a common outcome for the smoothest lane:

-

E-file

-

Direct deposit

-

No flags, mismatches, or manual checks

Your timeline can stretch for reasons that have nothing to do with you doing something “wrong.” The IRS runs fraud filters, cross-checks income documents, and routes some returns into manual handling. When that happens, the tracker may sit on Received longer than you’d expect.

The most common reasons your refund is delayed

Delays usually fall into a few buckets:

Credit-related timing holds

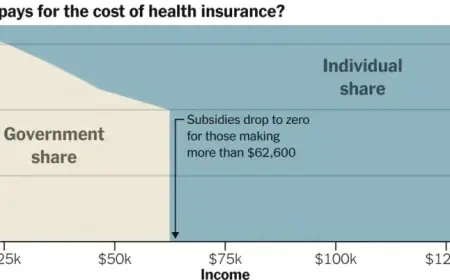

By law, refunds that include the Earned Income Tax Credit or the Additional Child Tax Credit cannot be issued before mid-February. Importantly, that hold applies to the entire refund, not only the portion tied to the credit.

Identity and fraud verification

If the system wants extra confidence it’s really you, the return can pause until verification is completed. This is one of the biggest reasons people see no movement for a while.

Mismatch or missing information

If reported wages, withholding, or other documents do not line up cleanly, the return may be pulled for review.

Paper filing

Paper returns remain slower and are far more likely to spend weeks just getting into the system.

Banking or deposit issues

A wrong routing or account number can turn an otherwise fast refund into a mailed check process or a rejection and reissue cycle.

What a partial government shutdown could change for refunds

A partial federal shutdown is in effect as of Monday, February 2, 2026, ET, and that can matter even during tax season.

Refund processing is heavily automated, so many straightforward refunds can still move. The bigger impact tends to show up in places where people are required:

-

Customer service and phone lines can thin out.

-

Manual reviews can slow down.

-

Backlogs can build quickly, and even a short disruption can take weeks to unwind.

In plain terms, the shutdown risk is less about stopping refunds entirely and more about widening the gap between simple returns and returns that need human intervention.

Behind the headline: why “Where’s My Refund” feels like a crisis every year

Context: Refunds function like a financial reset for many households. They’re used to catch up on bills, repair cars, pay down debt, or rebuild savings after the holidays.

Incentives: The IRS is pressured to send money quickly while preventing fraud. Lawmakers want speed when constituents are waiting, but also want enforcement and policy wins. Tax preparers and refund-advance products gain attention when people are stressed and looking for certainty.

Missing pieces: The tracker tells you status, not the reason. Many delays are invisible until the IRS requests more information by mail, which can feel like “nothing is happening” even when something is.

What happens next: realistic scenarios to watch

A normal, fast refund cycle

Trigger: E-file plus direct deposit, no credits subject to mid-February timing rules, no verification flags.

A mid-February release wave

Trigger: Returns with refundable credits begin moving after the legally required hold lifts, causing many statuses to change around the same period.

A slower lane for reviews

Trigger: If the return is pulled for manual handling, the timeline becomes less predictable, especially with shutdown-related staffing uncertainty.

A quick checklist if you’re tracking your IRS refund today

-

Confirm your return was accepted, not just submitted.

-

Use the exact refund amount from your filed return when checking status.

-

If you claimed the Earned Income Tax Credit or Additional Child Tax Credit, plan for mid-February or later.

-

Check once per day, not multiple times. More checks will not create more updates.

-

If the tracker asks for action, respond quickly; delays compound.

If you tell me whether you e-filed or mailed, whether you used direct deposit, and whether you claimed the Earned Income Tax Credit or Additional Child Tax Credit, I can map the most likely timeline range for your situation in 2026 without guessing a fake deposit date.