Oracle Launches Eight-Part Dollar Bond Sale Amid AI Funding Surge

Oracle Corp. has initiated an ambitious US dollar bond sale. The aim is to secure between $45 billion and $50 billion. This funding will support the expansion of their cloud infrastructure capacity.

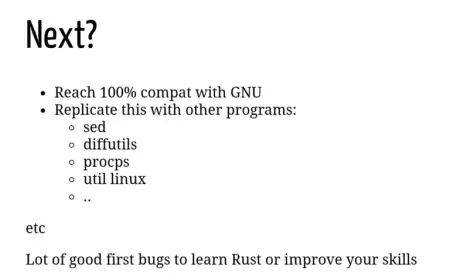

Details of the Bond Offering

The software giant plans a bond deal estimated between $20 billion and $25 billion. Multiple sources familiar with the matter disclosed this information while choosing to remain anonymous.

Purpose of Funding

The raised capital is intended for a combination of debt and equity sales. This move reflects Oracle’s commitment to enhancing its infrastructure capabilities in the rapidly growing cloud market.

Market Context

The bond sale comes at a pivotal time as interest in artificial intelligence (AI) technology surges. Companies like Oracle recognize the necessity of investing heavily in cloud services to remain competitive.

- Funding Range: $45 billion to $50 billion

- Bond Offering Size: $20 billion to $25 billion

- Key Area of Investment: Cloud infrastructure development

As Oracle navigates this substantial financial endeavor, stakeholders will be watching closely. The outcome could significantly influence the company’s position in the cloud service industry.