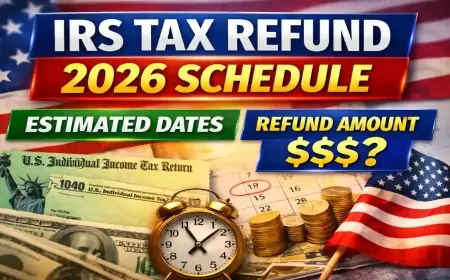

2026 IRS Tax Refund Schedule: Check Payment Amounts and U.S. Dates

The 2026 IRS Tax Refund Schedule is crucial as taxpayers across the United States prepare for the federal income tax season. As individuals ready their tax returns, understanding the likely timeline for refunds can help in managing finances more effectively. Though the IRS does not provide exact dates for refunds, historical data reveals valuable insights into payment expectations.

2026 IRS Tax Refund Schedule Overview

The IRS will initiate processing for tax returns filed from 26 January 2026. For most electronically filed returns, refunds are typically issued within 21 days. However, several factors can affect this timeframe.

- Filing Method: E-filing generally results in quicker processing compared to paper submissions.

- Direct Deposit: Choosing direct deposit minimizes delays associated with mailed checks.

- Accuracy: Errors or incomplete information can significantly slow down processing.

Key Dates and Details

| Filing Date | Acceptance Date | Expected Refund Date |

|---|---|---|

| 20-31 January 2026 | 7-14 February 2026 | Within 21 days |

| 1-7 February 2026 | 8-14 February 2026 | Within 48 Hours |

| 21-28 February 2026 | 15-21 February 2026 | Within 72 Hours |

| 28 Feb – 7 March 2026 | After 15 April 2026 | Following 2-3 Weeks |

Reasons for Potential Delays

Several circumstances may cause delays in receiving your tax refund:

- Paper Returns: Processing of paper returns tends to be slower due to potential backlogs.

- EITC/ACTC Claims: Extra scrutiny on these claims may delay refunds.

- Identity Verification: The IRS may require additional verification, causing hold-ups.

- Math Errors or Missing Info: Corrections or requested information can extend processing time.

- Discrepancies with Third-Party Forms: The IRS conducts checks to ensure accuracy, which may lead to delays.

Tips for Faster Refunds

To maximize the speed of your refund, consider these strategies:

- E-File: File your return electronically for reduced processing times.

- Direct Deposit: Use direct deposit to eliminate the potential for postal delays.

- Verify Information: Ensure your bank details are correct to avoid complications.

- File Early: Early submissions may reduce the risk of identity theft and mistakes.

- Stay Proactive: Set up your IRS online account for easier monitoring of your tax status.

Summary of 2026 IRS Tax Refund Information

Taxpayers should anticipate refunds between late January and April 2026. While exact dates may vary, a general understanding of traditional timelines can aid in financial planning. Early filing, direct deposit, and attention to detail are critical to ensuring a smooth refund process.

Frequently Asked Questions

How long does it usually take to get my IRS tax refund in 2026? Expect approximately 21 days for refunds if you e-filed and selected direct deposit without issues.

What should I do if my refund hasn’t arrived? Wait five business days, verify your banking information, and consider contacting the IRS if necessary.

Does e-filing make my refund faster? Yes, e-filing combined with direct deposit is the fastest method for receiving a refund.

For more information, please visit Filmogaz.com.