U.S. Stock Futures Decline Amid Bitcoin and Metals Market Sell-Off

Stock futures in the U.S. experienced a notable decline as investors reacted to fluctuations in virtual currencies and precious metals markets.

U.S. Stock Futures Decline

On the evening of February 1, 2026, U.S. stock futures faced significant setbacks. This downturn followed a weekend where Bitcoin prices dropped sharply, further amplified by a considerable sell-off in the precious metals market.

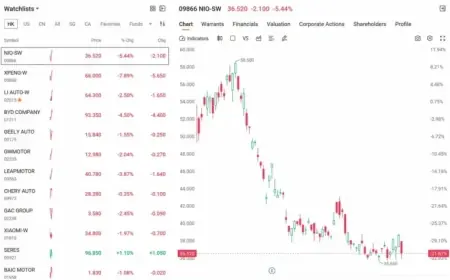

Market Performance Overview

The Dow Jones Industrial Average futures (YM00) fell approximately 340 points, marking a 0.7% decrease. Likewise, S&P 500 futures (ES00) slipped by 1.2%, while Nasdaq-100 futures (NQ00) dropped 1.5%. All three indices hit their session lows during the volatile trading period.

Key Events Influencing Markets

- Bitcoin experienced a weekend decline, impacting investor sentiment.

- Precious metals underwent a massive sell-off on Friday, adding to market instability.

- January 2026 concludes with a tumultuous trading atmosphere, marked by these significant declines.

This volatile trading environment highlights the ongoing interplay between digital currencies and traditional stock markets, particularly in challenging economic conditions.