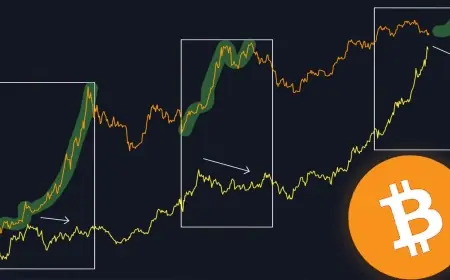

BTC Price Surpasses $81K, Sparking 2026 Fear Among Traders

Bitcoin’s recent decline below $84,200 has ignited significant anxiety among traders, according to analytics firm Santiment. The levels of negative commentary across social media platforms have reached a peak for 2026, indicating a shift in market sentiment.

Market Sentiment Shift

The decline has pushed bitcoin sentiment to its lowest point since November 21, 2022. This transition from cautiousness to fear often signifies that late sellers are capitulating. Santiment reports that the ratio of negative to positive commentary has heavily skewed towards pessimism.

Impact of Trader Sentiment on Market Movements

The influence of trader sentiment on the cryptocurrency market is significant. A heavily negative sentiment often leads to market corrections, primarily as traders liquidate positions due to fear. When sentiment swings dramatically, it can indicate a depletion of marginal sellers, especially after sharp downturns.

Potential Consequences of the Current Market State

- Fear spikes may continue for an extended period if macroeconomic conditions remain unstable.

- Bitcoin must reclaim critical levels, such as $90,000, to restore confidence.

- Choppy trading patterns persist across various asset classes including stocks, gold, and silver.

This broader de-risking trend can affect cryptocurrency markets through liquidity drains and leveraged positions. Despite the prevailing fear, it’s noteworthy that Santiment describes the current atmosphere as leaning more towards capitulation than a new phase of euphoria.

Behavior of Traders in Market Conditions

Typically, retail traders are inclined to sell during periods of peak pain, while institutional investors with longer investment horizons often seize the opportunity to buy. If bitcoin manages to stabilize and the wave of fear subsides, those currently expressing pessimism could become future rally chasers.

In summary, the fluctuation of bitcoin’s price and the resulting market sentiment present a complex interplay between fear and opportunity. Investors should remain attentive to macroeconomic trends and market cues as they navigate these turbulent times.