Bitcoin price slides as BTC breaks below $80,000 amid macro jitters

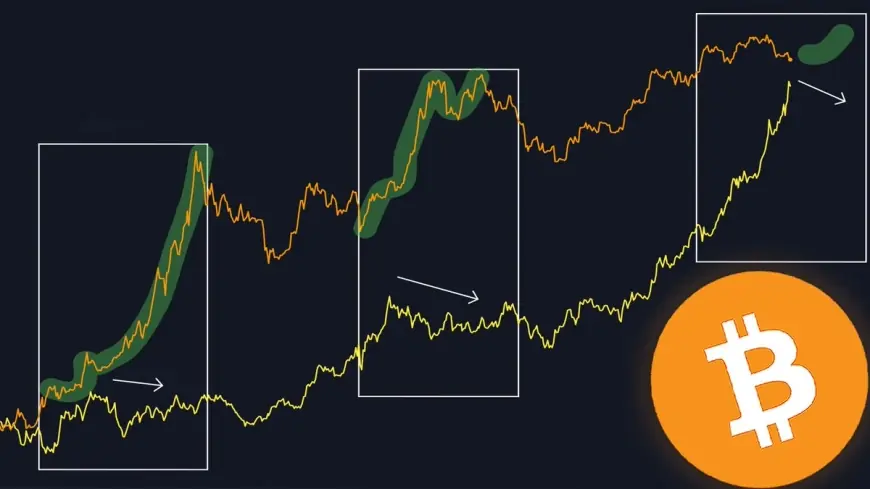

Bitcoin price fell sharply into the weekend, with BTC USD dropping below the $80,000 mark as traders digested a shift in U.S. monetary-policy expectations and another bout of risk-off positioning across crypto. As of 2:35 p.m. ET on Saturday, Jan. 31, 2026, btc price was about $77,499, down roughly 8.1% from the prior close in a volatile session that saw a low near $76,686.

Bitcoin price today: BTC USD at $77,499 after a steep slide

Market moves accelerated during thin weekend liquidity, when relatively small bursts of selling can push prices through widely watched “round-number” levels. Bitcoin’s intraday range has been wide, with BTC swinging between roughly $76,686 and $84,398 before settling back below $80,000.

| Metric | Level (ET) | Notes |

|---|---|---|

| BTC spot | $77,499 | As of 2:35 p.m. ET, Jan. 31 |

| 24h change | -8.1% | Versus prior close |

| Intraday low | $76,686 | Session low |

| Intraday high | $84,398 | Session high |

The drop also dragged major tokens lower. Ether fell more sharply in the same window, reflecting broad de-risking rather than a single-asset issue.

Why is bitcoin dropping?

The main driver traders are pointing to is macro pressure: rising concern that U.S. policy could stay tighter for longer, which tends to weigh on assets seen as higher risk. In the last 48 hours, markets have been adjusting to fresh signals around the future path of U.S. monetary policy, boosting the U.S. dollar and tightening financial conditions in ways that typically hit crypto first.

That macro narrative matters because bitcoin often trades like a “high-beta” risk asset during stress—moving more than stocks on the way down when investors want cash, short-duration instruments, or perceived safe havens.

Why is bitcoin crashing?

If you’re searching “why is bitcoin crashing”, the mechanics of the selloff are as important as the headline catalyst:

-

Positioning and leverage: When bitcoin breaks key levels, forced selling can cascade through derivatives as stop-losses trigger and leveraged positions unwind.

-

Weekend liquidity: Order books are often thinner on Saturdays, so declines can look more violent.

-

Sentiment reset: Crypto has been lagging other risk assets, and repeated failed rebounds can turn dips into momentum-driven exits.

In other words, the “crash” feeling can come from market structure—liquidations and low liquidity—stacked on top of a macro shock.

Stock market information for Bitcoin (BTC)

- Bitcoin is a crypto in the CRYPTO market.

- The price is 77499.0 USD currently with a change of -6854.00 USD (-0.08%) from the previous close.

- The intraday high is 84398.0 USD and the intraday low is 76686.0 USD.

Crypto news focus: ETF flows and risk appetite

Another pressure point has been investor behavior in U.S.-listed spot bitcoin ETFs. Recent sessions have seen large outflows, and January has leaned toward net selling rather than the steady inflows bulls had hoped would reassert themselves early in 2026.

Outflows don’t mechanically “set” bitcoin’s price, but they can amplify the tone: when the easiest on-ramp for many traditional investors is seeing withdrawals, it reinforces a risk-off loop—especially when paired with tighter-dollar narratives and higher real-yield expectations.

Michael Saylor, Strategy, and what the proxies are signaling

Michael Saylor has remained publicly committed to a long-term bitcoin thesis, while also highlighting governance and protocol-change risks as a structural issue for the ecosystem. That stance doesn’t stop drawdowns, but it shapes how parts of the market interpret them: as volatility to endure rather than a thesis break.

Meanwhile, bitcoin-linked equity proxies can diverge from the coin itself in the short term. Strategy (MSTR)—a major corporate bitcoin holder—was last indicated around $149.71, up about 4.6% from its previous close as of its latest trade timestamp (U.S. markets closed Friday).

What to watch next

The near-term question isn’t just whether bitcoin can reclaim $80,000, but whether the macro backdrop stabilizes:

-

Any further repricing of U.S. rate expectations could keep pressure on crypto.

-

Sustained ETF outflows would likely prolong the “sell rallies” mindset.

-

A calmer dollar and improving risk sentiment would make a mechanical bounce more likely, especially after a fast deleveraging move.

Sources consulted: Reuters; The Wall Street Journal; Bloomberg News; CoinDesk; Yahoo Finance; OpenAI Finance Tool