Trump Picks Warsh as Fed Chair, Silver Prices Tumble

The announcement of Kevin Warsh as President Donald Trump’s nominee for Federal Reserve Chair led to a significant decline in silver prices on Friday. Spot silver prices fell more than 37%, reaching approximately $84.63 per troy ounce just before 5 p.m. ET. This steep drop ended a remarkable surge for silver over the past year.

Impact on Silver and Gold Prices

Analysts noted that investors began selling off silver in anticipation of a shift in market dynamics. Despite Friday’s downturn, silver maintained an impressive increase of over 150% compared to the same period last year. Meanwhile, spot gold prices also experienced a decrease, falling about 11% on the same day, settling at around $4,864 per troy ounce. Gold, too, has seen substantial growth, increasing more than 70% over the past year as investors sought safe haven assets amidst economic uncertainty.

Market Trends and Investor Confidence

The U.S. dollar exhibited gains on Friday, reversing a downward trend observed earlier in the week. On Tuesday, the dollar recorded its worst performance since April 2025. The dual movement of investors selling precious metals while boosting the dollar indicates a growing sense of confidence in the market.

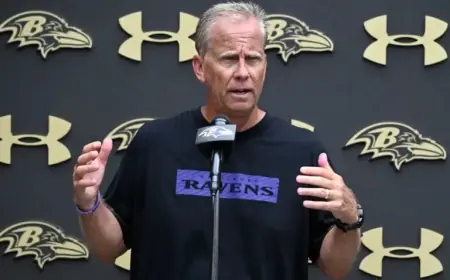

This newfound confidence is partly attributed to Warsh’s nomination, as he is viewed as an experienced figure for the Federal Reserve. Warsh, known for his hawkish stance on interest rates during his tenure on the Federal Reserve Board, has recently adjusted his views to align more closely with Trump’s administration. He has expressed criticism of the current Fed while hinting at a potential decrease in rates.

Stock Market Reaction

On the same day, major U.S. indices such as the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average ended slightly lower. Investors were weighing multiple factors, including an unexpected rise in the Producer Price Index, which contributed to the cautious market sentiment.

- Silver price drop: Over 37% to $84.63/oz.

- Gold price decline: 11% to $4,864/oz.

- Silver’s yearly increase: Over 150%.

- Gold’s yearly growth: Over 70%.

- U.S. dollar recovery: Following a decline earlier in the week.

The developments surrounding Warsh’s nomination and the subsequent market reactions reflect the volatility and interconnectedness of global financial markets. Investors will continue to monitor these trends closely as they navigate uncertain economic conditions.