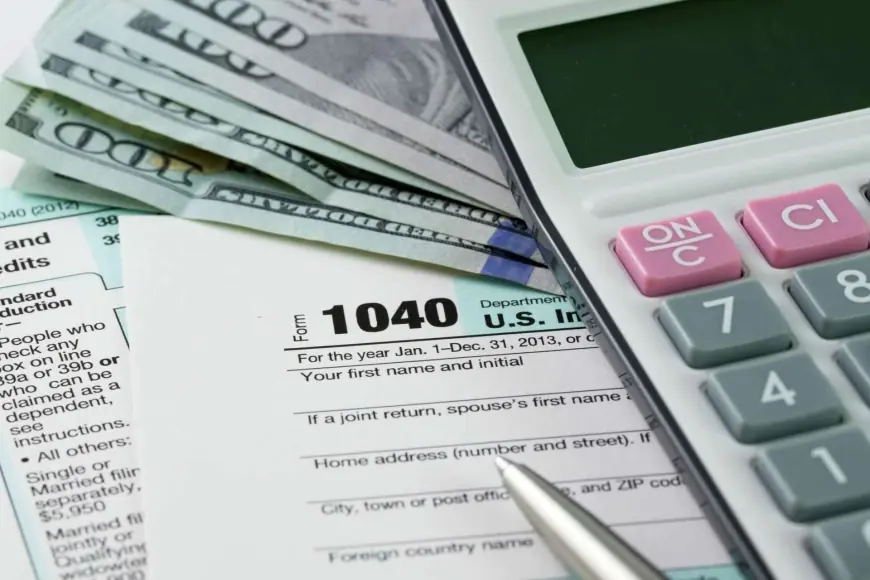

“Where’s My Refund” Searches Surge as IRS Refund Tracker Updates and 2026 Tax Season Gets Underway

With the 2026 tax filing season now open, “where’s my refund” has become one of the most searched money questions in the U.S., driven by a familiar mix of urgency and uncertainty: people want their cash, and they want a date. As of Saturday, January 31, 2026 ET, the Internal Revenue Service has already begun accepting 2025 tax-year returns, and the first wave of early filers is watching the IRS refund tracker for movement from “received” to “approved” to “sent.”

The attention spike is also a reminder that the refund process is less like a live package tracker and more like a batch system. For many filers, the tool will show no meaningful progress until the return is actually processed, even if it was transmitted successfully.

IRS Refund Status: What “Track My Refund” Really Measures

The IRS refund tracker typically shows three broad stages:

-

Return received: the IRS has the return and is processing it

-

Refund approved: the IRS has approved the refund and is preparing payment

-

Refund sent: the payment has been issued

The key point: “received” does not mean “reviewed,” and “sent” does not mean “in your account today.” Banks can add a short lag after the IRS issues the deposit, and mailed payments can take significantly longer.

Timing benchmarks many taxpayers use each year still apply:

-

If you e-file and choose direct deposit, many refunds are issued within about 21 days after the return is accepted, assuming no complications.

-

If you file on paper, status updates and refunds can take substantially longer.

-

If the IRS flags a return for identity verification, missing forms, suspected fraud, or calculation issues, the clock can stretch.

When Does the IRS Start Accepting Tax Returns, and Why That Date Matters

The IRS began accepting individual federal returns for the 2025 tax year on Monday, January 26, 2026 ET. That “opening day” matters because it anchors everything else: the sooner your return is accepted, the sooner it can enter the processing queue.

But opening week also creates a predictable mismatch between expectations and reality. People who file immediately often check the refund tracker multiple times a day, even though updates generally post no more than once daily. The result is widespread anxiety that something is wrong when, in most cases, nothing is.

Tax Filing Deadline: The Date That Shapes Refund Demand

The federal tax filing deadline for most taxpayers this season is Wednesday, April 15, 2026 ET. That date doesn’t just set a compliance deadline; it shapes consumer behavior:

-

Early filers tend to be refund-motivated and liquidity-sensitive, treating the refund as a planned cash inflow.

-

Later filers skew toward people gathering documents, self-employed filers managing deductions, or taxpayers who expect to owe.

This is why “when is my refund” becomes a seasonal headline: it’s not only about patience, it’s about household budgets, debt payments, rent timing, and major purchases.

Behind the Headline: Incentives, Stakeholders, and Why Confusion Persists

The incentives are straightforward:

-

Taxpayers want speed, certainty, and minimal friction.

-

The IRS wants accuracy, fraud prevention, and fewer service calls.

-

Financial institutions want deposits, but also need time to post and clear them.

-

Employers and payers want fewer corrected forms and fewer last-minute requests.

The stakeholder tension shows up in one place: processing checks that slow refunds down, especially around identity safeguards and refundable credits. Anti-fraud rules protect the system, but they also create delays that feel personal to families who rely on refunds as a once-a-year financial reset.

There’s also a second-order effect that has become more visible: as more payments move toward electronic delivery, taxpayers without stable banking access can experience slower access to funds, even when the IRS has technically issued the refund.

What We Still Don’t Know This Early in the Season

Even with clear start and deadline dates, several practical unknowns will define the next few weeks:

-

How quickly backlogs form if customer-service capacity tightens during peak filing volume

-

Whether identity-verification steps increase for certain categories of returns

-

How often filers need manual intervention because of mismatched wage statements or missing tax forms

-

How quickly banks post deposits compared with the issue date shown on the IRS tracker

What Happens Next: Scenarios to Watch and the Triggers That Matter

-

Routine refunds stay predictable for most e-filers

Trigger: clean returns with matching documents and direct deposit selections -

Delays concentrate among returns claiming certain refundable credits

Trigger: statutory hold periods and anti-fraud screening that slows issuance -

A wave of “stuck” statuses drives higher call volumes

Trigger: returns that remain in “received” longer than typical processing windows -

More filers shift to electronic filing and electronic payment delivery

Trigger: convenience and fraud concerns push behavior, even among late adopters -

Filing deadline pressure intensifies refund-related frustration

Trigger: April approaches, wait times rise, and small errors become harder to fix quickly

Practical Next Steps if You’re Checking “IRS Where’s My Refund” Today

-

If you e-filed, wait at least 24 hours after your return is accepted before expecting meaningful status detail.

-

If you mailed a return, expect a longer wait before the tracker reflects receipt.

-

Have three items ready when checking status: your taxpayer ID number, your filing status, and the exact refund amount from your return.

-

Avoid filing a second return just to “fix” a delay unless you are certain the original was not received; duplicate filings can create new problems.

The reason this story matters is simple: refunds are not just paperwork, they’re a major cash-flow event for millions of households. The earlier the season moves, the more those households will treat the refund tracker as a daily financial dashboard—whether or not the system is built to provide real-time reassurance.