Kevin Warsh nominated to lead the Federal Reserve as Powell’s term nears end

Kevin Warsh was tapped Friday, Jan. 30, 2026, to become the next chair of the Federal Reserve, setting up a high-stakes confirmation fight that could define the central bank’s independence and the direction of U.S. interest rates. The nomination comes with Jerome Powell’s chair term scheduled to end in May 2026, after months of escalating pressure from President Donald Trump for faster rate cuts.

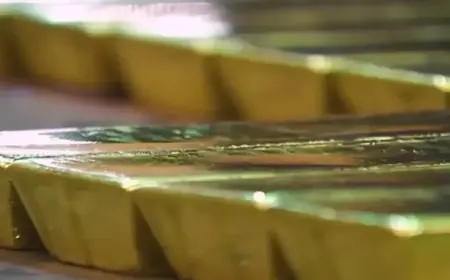

Markets moved quickly on the news: the U.S. dollar strengthened, Treasury yields rose, and precious metals sold off sharply as traders recalibrated expectations for policy and the Fed’s balance sheet.

Kevin Warsh nomination: what it means now

Warsh, 55, is not an unknown quantity in Washington or on Wall Street. He served as a Fed governor from 2006 to 2011, including through the 2008 financial crisis, and has spent years in policy circles and finance. His return to the center of monetary policymaking is being read as both a personnel change and a signal that the next Fed could lean harder into reforms—especially around the scale of the Fed’s asset holdings and how the institution explains its mandate.

The White House has framed the choice as a way to deliver lower borrowing costs and improved “affordability,” while critics argue the move risks blurring the line between elected officials and an institution designed to operate at arm’s length from politics.

Key takeaways

-

Warsh’s nomination accelerates the debate over Fed independence ahead of the 2026 midterm cycle.

-

His past hawkish instincts collide with more recent calls for easier policy, leaving his true reaction function under scrutiny.

-

Senate confirmation dynamics may be shaped by an ongoing federal investigation tied to Fed headquarters renovation costs.

The confirmation fight and the Powell shadow

Even before Warsh’s nomination, Powell’s relationship with the White House had become openly adversarial. That tension now carries directly into the confirmation process. At least one Republican senator has already signaled an intention to slow-roll Fed nominations until clarity emerges around a Justice Department investigation connected to costs tied to the Fed’s Washington headquarters renovation. Democrats, meanwhile, are expected to press Warsh on whether he would resist political pressure on rates and maintain the Fed’s inflation-fighting credibility.

One wrinkle: Powell’s term as chair ends in May, but he can remain on the Board of Governors beyond that date. How long Powell stays—if at all—could shape the optics of the transition and the internal dynamics of the Fed during the handoff.

A record metals rally reverses on policy expectations

Friday’s nomination landed into a market already stretched by a historically powerful January move in precious metals. Gold and silver had surged to record territory earlier in the week, then abruptly reversed. As the Fed leadership news hit, the dollar’s bounce added pressure and profit-taking intensified, sending gold down sharply and dragging silver, platinum, and palladium with it.

The reaction highlights how sensitive the metals complex has become to shifts in perceived policy direction: tighter financial conditions and a stronger dollar tend to weigh on dollar-priced commodities, while a credible path to rate cuts can support them. The magnitude of the move also suggests positioning mattered—when a trade is crowded, even a modest narrative shift can trigger a fast unwind.

Warsh’s record: crisis-era Fed, reform agenda, and balance sheet focus

Warsh built his reputation inside the Fed during the crisis years, often serving as a bridge between the central bank and financial markets. After leaving the Fed in 2011, he became a prominent voice urging changes to how the institution operates—especially questioning the side effects of a large balance sheet and the scope of the Fed’s role beyond inflation and employment.

In more recent years, he has spoken in ways that can be read in two directions: supportive of easier policy when inflation is under control, but also skeptical of the Fed becoming overly political or expansive. That combination is why investors are split on what his leadership would mean in practice. Some see a market-friendly technocrat who would protect credibility; others see a chair who could be pulled toward the White House’s preferred rate path.

What happens next: timing, signals, and the first real test

The next major milestone is the Senate confirmation schedule. Hearings will likely focus on three questions: how Warsh defines Fed independence, how he would weigh inflation versus growth if the two goals conflict, and whether he would commit to a concrete plan for the balance sheet.

For markets, the first real test will come before he ever takes the gavel: traders will parse every public statement for clues about the speed of cuts, tolerance for inflation overshoots, and willingness to tighten financial conditions through balance sheet reduction even while lowering policy rates. If confirmation drags into spring, uncertainty itself could keep volatility elevated across rates, the dollar, and risk assets.

Sources consulted: Reuters; Associated Press; The Washington Post; TIME; Federal Reserve History; PBS NewsHour