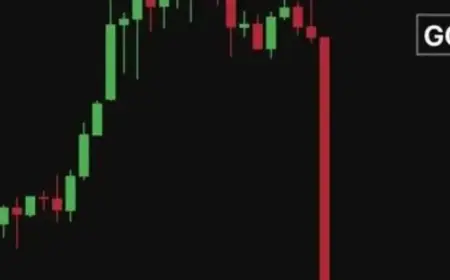

Sam Altman ‘Friendship’ Costs Microsoft $360 Billion in One Day

On January 28, 2024, Microsoft experienced a staggering $360 billion drop in market value. This incident marks the second-largest single-day decline in U.S. stock history, trailing only Nvidia’s previous downturn. The cause? Microsoft’s deep financial commitment to OpenAI, led by CEO Sam Altman.

Microsoft’s Financial Turmoil Linked to OpenAI

Microsoft’s partnership with OpenAI has become a significant liability. The tech giant invested $13 billion in OpenAI, which lost over $8 billion last year. It has also been reported that OpenAI burns through approximately $15 million daily in operational costs related to video generation.

Wall Street’s Concerns Grow

The stark reality of Microsoft’s financial situation hit during the Q1 2026 earnings call. It was revealed that OpenAI constitutes 45% of Microsoft’s future cloud contracts, valued at $625 billion. Despite these numbers, OpenAI struggles to maintain user growth and faces intense competition from Google and others.

- OpenAI lost $12 billion during the last quarter.

- Microsoft’s cloud growth for Azure slowed to 39%, below Wall Street expectations.

The Circular Financing Dilemma

The financial relationship between Microsoft and OpenAI has been described as “circular financing.” Essentially, Microsoft funds OpenAI, which in turn pays Microsoft for cloud services. This creates a façade of mutual success but obscures the underlying financial instability.

Expanding Financial Commitments

Microsoft’s recent spending surge is alarming. Capital expenditures reached $37.5 billion last quarter, up 66% year-over-year. A significant portion of this budget is allocated to GPUs and AI infrastructure, which depreciates rapidly.

- Two-thirds of Microsoft’s spending went towards AI resources.

- CFO Amy Hood stated that this expenditure strategy is strategic, despite market skepticism.

Market Reactions and Future Implications

Investors reacted swiftly to the financial revelations, leading to a collective sell-off in the tech sector. Not only did Microsoft experiences a sharp decline, but other software companies also saw drops in their stock prices, reflecting widespread concern about overvalued AI investments.

Potential Risks Ahead

Analysts warn of dire consequences if OpenAI fails. Microsoft is contractually bound to OpenAI until 2030, which restricts its ability to pursue independent AGI (Artificial General Intelligence) developments. This could leave Microsoft vulnerable if OpenAI cannot stabilize its operations.

Furthermore, Deutsche Bank projects OpenAI could incur losses of $140 billion between 2024 and 2029. Meanwhile, the pressure mounts as market sentiments shift, pointing to a critical juncture for both companies.

Conclusion

January 28, 2024, serves as a pivotal moment in Microsoft’s corporate history. The repercussions of its financial ties to Sam Altman and OpenAI could reshape the company’s operations and reputation. Investors and analysts alike are now watching closely as the tech giant navigates these turbulent waters.