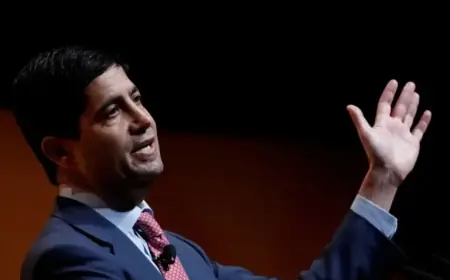

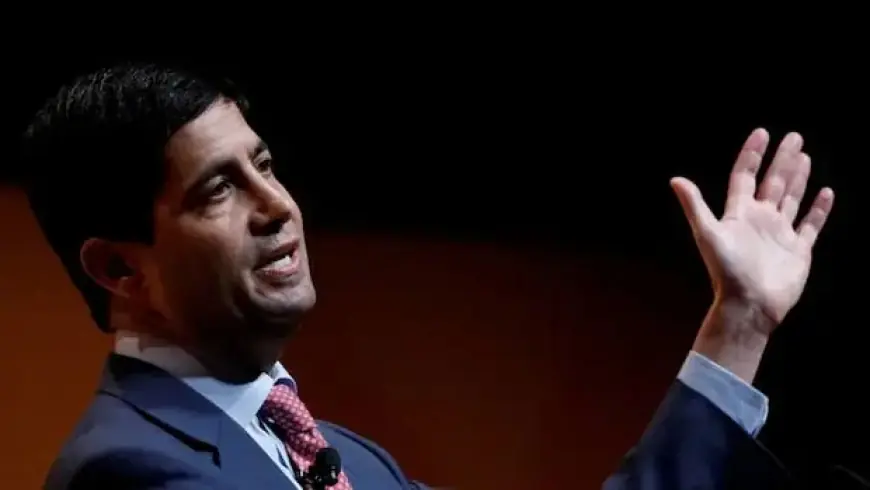

Kevin Warsh Selected by Trump as Next Federal Reserve Chair

President Donald Trump has announced plans to nominate Kevin Warsh as the next Chair of the Federal Reserve. Warsh, a former Fed official, would succeed Jerome Powell when his term ends in May. This nomination indicates a potential shift in the Fed’s policies that may align more closely with the White House.

About Kevin Warsh

Kevin Warsh, 55, previously served on the Federal Reserve Board from 2006 to 2011. He was the youngest governor in the Fed’s history when appointed at age 35. Currently, he is a fellow at the Hoover Institution and teaches at the Stanford Graduate School of Business.

Warsh’s Economic Ideology

Although Warsh has a reputation as a hawk—typically favoring higher interest rates to manage inflation—his recent statements have indicated support for lower rates. This contrasts with Trump’s preference for keeping rates as low as one percent, significantly below the current rate of approximately 3.6 percent.

Impacts of the Nomination

If confirmed by the Senate, Warsh’s leadership could consolidate Trump’s influence over the Fed, traditionally regarded as an independent entity. This nomination follows an unusually public search process, reflecting the importance of the role in shaping economic policy.

Historical Context

Warsh’s past experiences include serving as an economic advisor in the George W. Bush administration and working closely with former Fed Chair Ben Bernanke during the 2008 financial crisis. His familiarity with the workings of the Fed and previous objections to low-interest policies highlight a complex relationship with the Federal Reserve.

Challenges Ahead

Warsh would likely fill a temporary seat occupied by Stephen Miran before potentially rising to the chair position. As chair, his authority would face challenges from other board members and external pressures from financial markets.

- Potential Internal Conflicts: The Fed’s rate-setting committee is divided on whether to lower rates or maintain them to combat inflation.

- Market Reaction: Aggressive rate cuts could provoke Wall Street to react negatively, potentially increasing long-term borrowing costs.

Conclusion

Kevin Warsh’s potential appointment as the next Federal Reserve Chair represents a significant development in U.S. economic policy. Should his nomination be confirmed, it could lead to a notable change in the Fed’s approach to interest rates, emphasizing Trump’s desire for greater control over monetary policy.