Trump Appoints Kevin Warsh as New Federal Reserve Chair

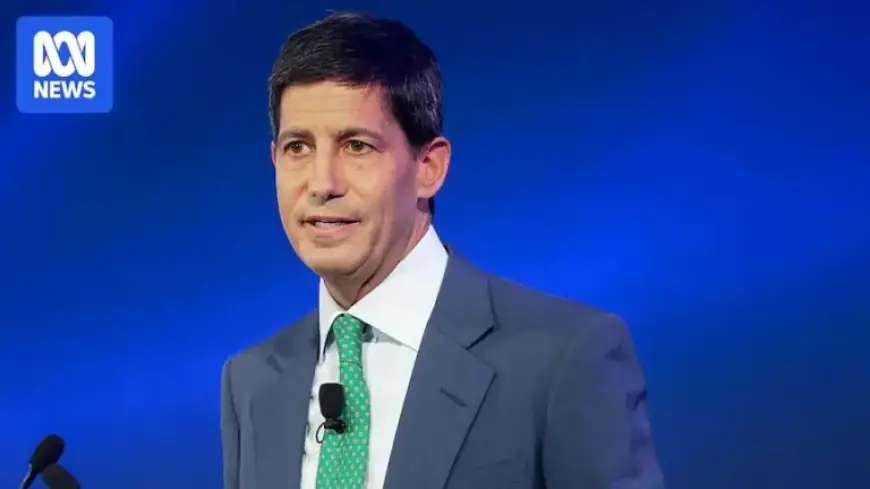

Former Federal Reserve governor Kevin Warsh has been selected by U.S. President Donald Trump to lead the Federal Reserve, marking a significant potential shift in the institution’s direction. Warsh’s appointment is poised to enhance ties between the Fed and the White House, likely reducing the bank’s long-standing independence.

Key Details of the Appointment

Kevin Warsh will succeed Jerome Powell as chair when Powell’s term concludes in May. Trump’s endorsement highlights Warsh as a capable leader. “I have known Kevin for a long period of time and have no doubt he will be one of the GREAT Fed Chairmen,” Trump stated.

- Warsh’s Background: Kevin Warsh previously served on the Fed’s board from 2006 to 2011. He became the youngest governor in history at age 35.

- Current Role: Warsh is currently associated with the Hoover Institution and teaches at Stanford Graduate School of Business.

- Potential Confirmation: His appointment requires Senate approval before he can officially take over the role at the Federal Reserve.

Warsh’s Economic Stance

Warsh holds a reputation as a “hawk” in monetary policy, advocating for higher interest rates to manage inflation. Yet, his recent comments have shifted, showing support for lower rates, aligning more with Trump’s vision of interest rates around 1 percent.

This approach contrasts sharply with the current Fed rate, hovering at approximately 3.6 percent. During his tenure, Warsh expressed concerns regarding inflation and the Fed’s low-rate policies following the 2008 financial crisis.

Implications for the Federal Reserve

Warsh’s potential leadership may reflect President Trump’s desire for greater influence over this vital federal agency. The Federal Reserve plays a crucial role in shaping economic policies, combating inflation, and regulating banking.

- Central Banking Authority: The chair oversees monetary policy decisions that affect borrowing costs across various sectors, including mortgages and credit cards.

- Role in Employment: The Fed is responsible for promoting maximum employment in addition to regulating inflation.

Future Challenges

Upon confirmation, Warsh may face opposition in his efforts to lower interest rates amid a divided committee at the Federal Reserve. Some members remain cautious about inflation trends, while others advocate for reduced rates to stimulate economic growth.

Trump’s previous criticism of Jerome Powell—as not acting quickly enough to adjust rates—highlights the political pressures that may influence Warsh’s decisions. Financial markets may react negatively to policies perceived as politically motivated, affecting Treasury bond sales and broader economic conditions.

Background Considerations

While Warsh was previously a consideration for chair during Trump’s first term, Powell was ultimately selected. Warsh’s connections, including familial ties to Ronald Lauder, may also play a role in his appointment and governance approach.

As the landscape for U.S. monetary policy potentially shifts, all eyes will be on Warsh’s confirmation and the subsequent directions he may take at the helm of the Federal Reserve.