Silver Surges Past Rs 4L/kg; Gold Nears Rs 2L/10gm Milestone

On Thursday, silver prices surged past the historic Rs 4 lakh per kilogram mark, reflecting a remarkable rally that has persisted for over two years. This milestone comes amidst rising geopolitical tensions, which have influenced international market dynamics for precious metals.

Gold Prices Approach Rs 2 Lakh Milestone

Gold is also experiencing significant gains, with prices nearing Rs 1.8 lakh per 10 grams on the Multi Commodity Exchange (MCX). This ongoing rally in gold has been observed for more than a year, underscoring the increasing demand for safe-haven assets.

International Market Trends

In international trading, silver reached over $120 per ounce for the first time, while gold surpassed $5,600 per ounce. However, both metals experienced slight declines as investors locked in profits following their record highs. Silver saw a drop of 6%, and gold fell by 4%.

Current Market Analysis

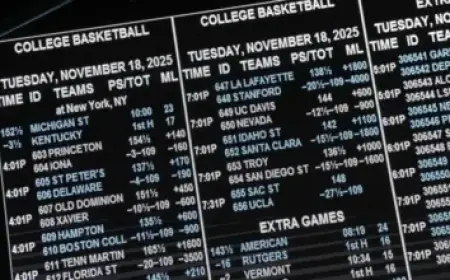

As of late trading on MCX, gold futures for February delivery hovered around Rs 1.75 lakh, reaching a peak of nearly Rs 1.81 lakh throughout the day. With February contracts set to expire, April futures emerged as the most actively traded, touching Rs 1.93 lakh.

For silver, March futures traded at Rs 4.2 lakh, marking the highest price recorded on the same day. This increase is driven by economic uncertainty and a growing preference among investors for tangible assets amid fluctuating paper currency values.

Expert Insights

According to industry expert Rahul Kalantri from Mehta Equities, the rally in gold and silver is fueled by heightened demand for safe assets as geopolitical and economic conditions remain unstable. The U.S. Federal Reserve’s decision to maintain interest rates supports the notion of extended monetary support, further driving investment away from currencies and towards precious metals.

Geopolitical Factors

- U.S. President Donald Trump’s comments on Iran have escalated geopolitical tensions.

- Warnings of severe military responses from the U.S. could heighten economic uncertainty.

The combination of these factors suggests a continuing trend in precious metal investments as individuals seek protection against market instability. Investors appear to favor the strength and security that precious metals like silver and gold provide in uncertain times.