USD Today: Dollar Holds Firm After the Fed Hits Pause, With Traders Watching Rates, Risk Mood, and Emerging-Market Pressure

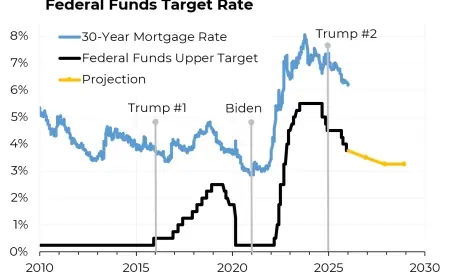

The US dollar is trading mostly steady today, Thursday, January 29, 2026 ET, as markets digest the Federal Reserve’s decision late Wednesday, January 28, 2026 ET to keep interest rates unchanged. The policy pause matters because it preserves the dollar’s yield advantage without adding fresh shock to global borrowing costs, leaving traders focused on what comes next: inflation progress, labor-market cooling, and whether growth stays resilient enough to delay rate cuts.

The day’s price action reflects that balance. The dollar is not surging, but it is not fading either. Instead, it is hovering in a range that signals “wait for the next data point,” while pushing pressure onto countries and companies that rely heavily on dollar funding.

USD Today: The Levels Markets Are Fixated On

As of mid-morning Thursday, January 29, 2026 ET, the broad dollar gauge that tracks the currency against major peers is around the mid-96 range, up modestly from earlier in the week.

In major currency pairs:

-

The euro is trading near the high-1.19 area versus the dollar, after a choppy week that saw sharp intraday swings.

-

In Egypt, the dollar is trading near 47.15 Egyptian pounds on widely followed reference rates, with the past week roughly confined to the 47.05 to 47.47 range.

These numbers can vary by bank, payment provider, and transaction type once fees and spreads are applied. But the core story is consistent: the dollar is stable, not collapsing, and that stability keeps global financial conditions tight.

What’s Driving the Dollar Right Now

The immediate catalyst is the Fed’s message: no rush to cut. By holding rates steady, the central bank signaled it wants more confidence that inflation is truly contained before easing policy. That stance typically supports the dollar because higher US yields, or the expectation they will stay higher, attract capital.

At the same time, the dollar’s upside is capped by two realities:

-

Markets have already priced in the idea that cuts are likely later this year if inflation drifts down.

-

Risk appetite can weaken the dollar’s bid if investors rotate into higher-yielding or growth-sensitive assets.

So the dollar is caught between yield support and the market’s instinct to look ahead to eventual easing.

Behind the Headline: Incentives, Pressure Points, and Who Has Leverage

This is not just about currency charts. It is about incentives.

For the Fed, the incentive is credibility. Cutting too early risks reigniting inflation and undermining confidence in the inflation target. Holding too long risks squeezing jobs and growth. Staying on pause while repeating “data-driven” is the least committal path that keeps options open.

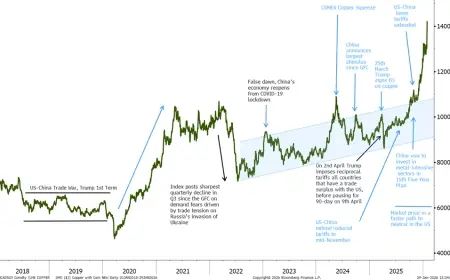

For global investors, the incentive is carry and safety. A steady or firm dollar paired with relatively high US yields can look attractive, especially when geopolitics, trade uncertainty, or growth scares return. That can pull money toward dollar assets and away from riskier markets.

For emerging markets, the incentive is defense. A stable-to-firm dollar makes it harder to reduce local interest rates, because easing can weaken local currencies further, raising the cost of imports and dollar-denominated debt service. Even when exchange rates are managed or heavily influenced by policy, the dollar’s global tone still bleeds into local pricing, financing, and inflation expectations.

The stakeholders are broad:

-

US households, via borrowing costs and inflation

-

Global companies with dollar debt, via refinancing and hedging costs

-

Import-dependent economies, via food, fuel, and industrial inputs priced in dollars

-

Commodity markets, where a firm dollar can restrain prices in local-currency terms

-

Governments balancing growth against currency stability

What We Still Don’t Know

Several missing pieces will decide whether the dollar stays range-bound or breaks out:

-

Whether upcoming inflation prints show continued cooling or a plateau

-

Whether job growth slows enough to change the Fed’s risk calculus

-

How financial conditions evolve if equities wobble or credit spreads widen

-

Whether geopolitical or trade shocks trigger a global flight into dollars

-

How quickly markets shift from “pause” to “cuts are imminent”

Until those uncertainties resolve, the dollar’s “today” story is mostly about positioning and risk management rather than a clean directional trend.

What Happens Next: Scenarios and Triggers to Watch

Here are realistic paths for the dollar over the next few weeks, with clear triggers:

-

Dollar firms further

Trigger: inflation proves sticky, growth stays strong, and rate-cut expectations move later. -

Dollar softens gradually

Trigger: inflation cools convincingly and the market starts pricing earlier or deeper cuts. -

Dollar jumps on risk-off moves

Trigger: a sharp equity selloff, geopolitical escalation, or credit stress pushes investors into safety. -

Dollar chops sideways

Trigger: mixed data keeps the Fed on pause and leaves traders reluctant to commit. -

Emerging-market strain intensifies even without a dollar surge

Trigger: local inflation or funding pressures rise, forcing tighter local policy despite weak growth.

Why USD Today Matters in Practical Terms

A stable dollar at elevated levels is not neutral. It tends to:

-

Keep imported inflation risks alive in many economies

-

Raise the real cost of servicing dollar-linked obligations

-

Make it harder for central banks outside the US to ease policy

-

Shift corporate planning around pricing, inventory, and hedges

In other words, USD today is less about a dramatic move and more about an ongoing constraint. The dollar does not need to spike to shape decisions; it only needs to stay firm long enough to force trade-offs across households, companies, and governments worldwide.