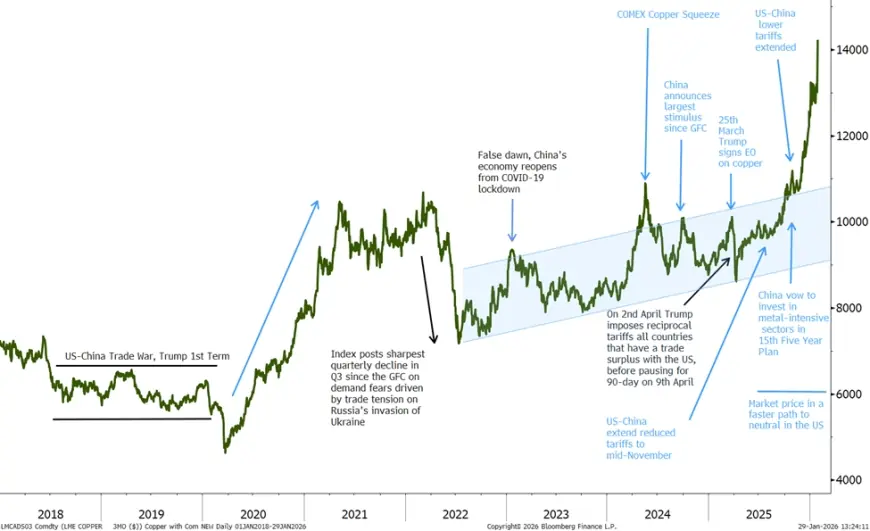

Copper price today jumps to fresh highs as traders chase metals rally

The copper price today is sharply higher on Thursday, Jan. 29, 2026, with global benchmark contracts trading around the $14,000-per-metric-ton level and U.S. pricing hovering in the low-to-mid $6 per pound range. The move extends a broader metals surge that has pulled in both short-term momentum traders and longer-term investors looking for inflation protection.

Copper’s jump is drawing extra attention because it sits at the center of real-world supply chains, from power grids and construction to electric vehicles and data centers. Further specifics were not immediately available on how much of the day’s buying is tied to physical orders versus financial positioning.

Where copper is trading and why the quotes can look different

Copper is quoted in multiple ways, and the number you see depends on the venue and product. Globally, a common benchmark is three-month copper priced per metric tonne, while many U.S. screens emphasize futures priced per pound. On Thursday, the two measures are telling the same story: a rapid climb to levels not seen before in this cycle.

Intraday swings have also been pronounced. Some specifics have not been publicly clarified, including how much of the session’s extreme moves were driven by short-term stop orders, option hedging, or end-of-month rebalancing flows.

What’s fueling the rally across “hard assets”

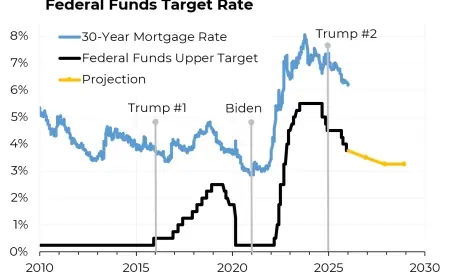

Copper tends to rally when traders expect stronger industrial demand, tighter supply, or financial conditions that encourage investors to move into real assets. This week’s surge has been reinforced by a mix of macro forces that can move commodity prices quickly: currency shifts, changing interest-rate expectations, and elevated geopolitical uncertainty.

At the same time, copper has its own supply-and-demand narrative. Refinery output, mine disruptions, and shipping constraints can all tighten availability with little warning. When inventories look less comfortable or delivery costs rise, prices can react fast—even if end-user demand is not visibly accelerating in the same moment.

How copper pricing typically works

Copper’s “headline price” is often a benchmark futures contract, not a single cash transaction for physical metal. Futures contracts represent an agreement to deliver (or settle) copper at a later date, and their price reflects traders’ best collective estimate of what copper is worth under current conditions.

Physical buyers and sellers—wire and cable manufacturers, construction suppliers, and fabricators—often negotiate contracts based on a benchmark plus premiums that reflect location, shipping, and immediate availability. When futures prices surge, those physical deals can lag, tighten, or widen depending on whether metal is truly scarce in warehouses and along transport routes. That’s why a fast-moving screen price can sometimes race ahead of what day-to-day buyers feel immediately.

Who feels higher copper prices first

The impact lands unevenly. Manufacturers that use large amounts of copper—electrical equipment makers, automakers with EV exposure, appliance producers, and builders—can see input costs rise quickly, especially if they buy spot or have limited hedging in place. Utilities and grid contractors may face higher costs for transformers, cabling, and substation upgrades, which can pressure project budgets and timelines.

On the other side, miners, smelters, and scrap dealers often benefit from rising prices, at least in the near term, as revenue per unit increases. Consumers can feel knock-on effects later through higher prices for goods that embed copper, and through infrastructure costs that can eventually pass through to bills and taxes.

What comes next on the calendar

In the days ahead, traders will be watching whether copper can hold these elevated levels once the initial surge cools and positions are reassessed. Two near-term checkpoints are macro-heavy: the next U.S. inflation update, scheduled for Wednesday, Feb. 11, 2026, and the next scheduled Federal Reserve policy meeting on March 17–18, 2026. If the rally is being driven primarily by currency and rate expectations, those events could shape the next leg—up or down—more than any single mine headline.