Where’s My Refund 2026: IRS Opens Filing Season, Sets Deadline, and Warns Some Tax Refunds Will Take Longer

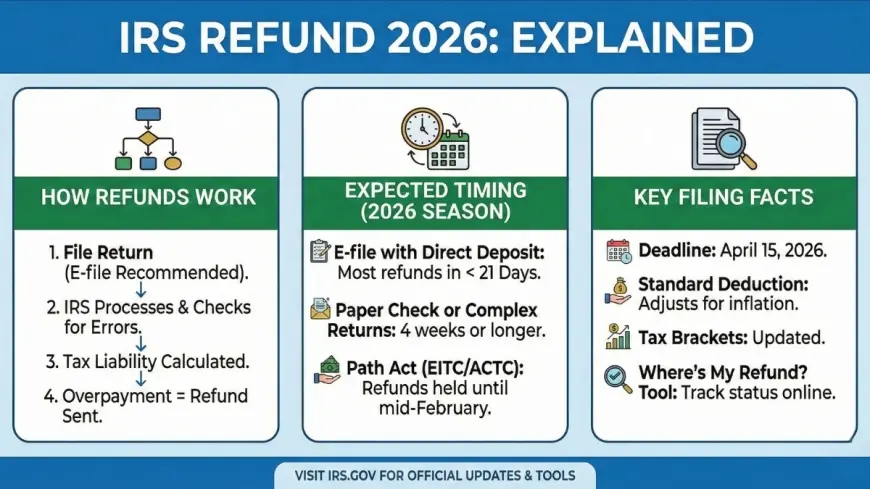

Where’s my refund is once again one of the most searched questions as the IRS begins processing 2025 tax returns and millions of filers look for early deposit dates. The IRS says the 2026 filing season is now open, meaning federal individual returns can be accepted and processed, and taxpayers can start tracking progress through the agency’s refund tools.

The headline dates are straightforward, but the fine print matters this year: not every return moves at the same speed, and some refunds are legally delayed even when the return is accurate.

The IRS start date for accepting returns and the tax filing deadline

The IRS says it opened the 2026 tax filing season on Monday, Jan. 26, 2026 ET, and began accepting and processing federal individual income tax returns for tax year 2025. The agency expects roughly 164 million individual returns to be filed.

For most taxpayers, the federal tax filing deadline is Wednesday, April 15, 2026 ET. That deadline covers both filing the return and paying any tax still owed for 2025.

Further specifics were not immediately available about how quickly overall processing times might vary week to week as filing volume climbs.

IRS Where’s My Refund: what the tracker shows and when it updates

The IRS “Where’s My Refund” tracker is designed to answer a narrow question: whether the agency has received your return, approved your refund, and sent the payment. The tracker typically moves through three stages: Return Received, Refund Approved, and Refund Sent.

Timing is the biggest point of confusion. The IRS says refund status generally appears about 24 hours after you e-file a current-year return, and around four weeks after you file a paper return. The tracker is usually updated once per day, so repeated checks during the same day often do not change what you see.

Mechanically, here’s what is happening behind the scenes. After a return is accepted, the IRS runs automated checks against reported wages, withholding, and basic identity signals. If those checks clear, the return can move quickly to approval. If something flags for review, the return may be pulled for additional verification, which can pause the timeline before a refund date is generated.

Why your IRS tax refund may take longer than expected

The IRS says most refunds are issued within 21 days for taxpayers who file electronically and choose direct deposit, but there are common reasons a refund can take longer. Errors, missing information, suspected identity theft or fraud screening, and returns that require extra review can all slow processing.

Paper returns are a separate bottleneck. The IRS says processing a mailed return can take six weeks or more, even before you factor in postal delays or the time it takes for your refund to be delivered by check.

Certain credits can also change the calendar. The IRS says refunds tied to the Earned Income Tax Credit and the Additional Child Tax Credit are expected to be available by March 2, 2026 for many eligible filers who chose direct deposit and have no other issues with their returns. The reason those refunds do not arrive earlier is rooted in fraud-prevention rules that require extra time before release.

Some specifics have not been publicly clarified about how many returns will require manual review this season compared with last year.

What taxpayers can do now to speed up “where my refund” answers

For taxpayers focused on speed, the most reliable path is e-filing with direct deposit, double-checking Social Security numbers, and making sure income documents match what employers and payers reported. Small mismatches can trigger additional review, and that can turn a fast refund into a longer wait.

Filers using storefront preparers such as Jackson Hewitt, or doing it themselves with online software, can reduce delays by waiting until key forms arrive and verifying withholding amounts before submitting. For people without bank accounts, refund delivery options can be more limited and slower, so planning ahead matters.

The impact is not evenly distributed. Households that budget around refund timing, including families claiming refundable credits, can feel real pressure if money arrives later than expected. Taxpayers who file on paper, older adults who prefer mailed checks, and workers with multiple income sources can also face longer timelines if extra verification is needed.

The next milestone many filers are watching is late February, when the IRS says its refund tracker should begin displaying projected deposit dates for many early credit-related filers, followed by the March 2, 2026 window when a large share of those refunds are expected to become available through direct deposit.