Where’s My Refund is back in focus as the IRS opens the 2026 tax season

Where’s My Refund is once again the question of the season as the IRS begins processing 2025 federal returns and millions of filers start watching for updates, direct deposits, and any sign of delays. The agency opened the 2026 filing season on Monday, January 26, 2026, meaning tax returns can now be accepted and processed rather than simply prepared and held.

When the IRS started accepting tax returns and the 2026 tax filing deadline

The IRS began accepting and processing 2025 individual income tax returns on January 26, 2026, kicking off the annual rush that typically builds through February and March. For most taxpayers, the federal tax filing deadline and payment deadline is Wednesday, April 15, 2026.

If you need more time, an extension request is also due by April 15, 2026, but an extension to file is not an extension to pay. Anyone who expects to owe should plan a payment by the April deadline to reduce penalties and interest.

Some specifics have not been publicly clarified, including how quickly certain specialized returns will move through additional review steps this season.

How Where’s My Refund works and what each status actually means

The IRS refund tracker is designed to show progress through three stages: Return Received, Refund Approved, and Refund Sent. In real life, that translates to a simple pipeline: the IRS receives your return, runs it through processing and verification checks, approves the refund amount, and then issues payment.

Timing depends heavily on how you file. The refund tracker typically shows up for current-year electronic filers within about 24 hours after an accepted e-file. Paper returns take much longer to appear, often around four weeks after mailing. The system updates once a day, usually overnight, so checking repeatedly during the day won’t speed anything up or reveal new information.

Further specifics were not immediately available about the exact timing of updates for every account on every day, but the once-daily update cycle is the standard expectation.

Why IRS tax refunds get delayed even when you filed “correctly”

Most IRS tax refunds are issued in fewer than 21 calendar days for electronic filers, especially when direct deposit is used. But several common issues can slow things down:

Errors or mismatches on names, Social Security numbers, or dependent information

Missing forms or incomplete income reporting

Returns that require extra identity verification

Refundable credits that trigger additional review steps

There is also a well-known timing constraint for certain refundable credits. By law, refunds that include the Earned Income Tax Credit or the Additional Child Tax Credit cannot be issued before mid-February, and that hold applies to the entire refund, not just the credit portion. That means some early filers will see their return accepted quickly but still wait longer for the money.

Mechanism-wise, this is the tradeoff of a system built to prevent fraud: the IRS processes the return, matches key information against forms filed by employers and payers, verifies credits, and only then finalizes the refund release.

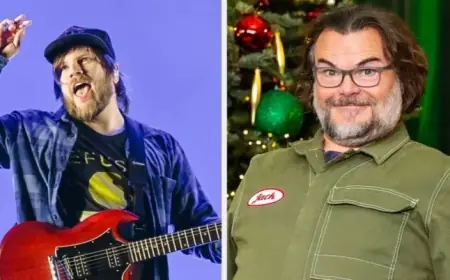

What Jackson Hewitt and other preparers can do, and what they cannot

Tax prep brands like Jackson Hewitt can help with filing accuracy, e-filing setup, and choosing direct deposit, which are the biggest controllable factors for refund speed. They can also confirm when a return has been transmitted and accepted through e-file channels, which is often the first reassurance filers want.

What preparers generally cannot do is move you ahead in the IRS processing line once the return is accepted. The official refund status steps and the underlying review process are controlledught to the IRS system, and repeated calls or repeated status checks won’t accelerate it.

This matters most for two groups: households counting on a refund to cover essentials and taxpayers who are worried about owing and want clarity before the April deadline. It also affects tax preparers and call centers, which tend to see the highest volume when refunds slow down or when people expect money on a specific date.

As the season progresses, the next milestone for most filers is the April 15, 2026 filing and payment deadline. For many credit claimants, another key milestone is the mid-February window when certain held refunds can begin moving from approved to sent once required checks are completed.