ASX Set for Gains as Gold Prices Surge

The Australian Securities Exchange (ASX) is set to experience gains as gold prices surge significantly in the market. Key indicators suggest a positive trend, with futures up by 0.8%, reaching 8,895 points.

Current Market Overview

As of early morning, the Australian dollar has appreciated by 0.4%, standing at 69.18 US cents. International markets are also seeing gains, with the S&P 500 and Dow Jones both rising by 0.7%, and Nasdaq increasing by 0.6%.

- S&P 500: 6,960 points (+0.7%)

- Dow Jones: 49,434 points (+0.7%)

- Nasdaq: 25,759 points (+0.6%)

- FTSE: 10,149 points (+0.1%)

- EuroStoxx: 610 points (+0.2%)

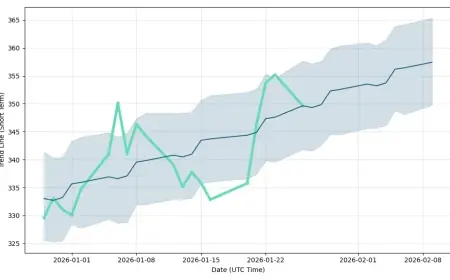

Gold Prices on the Rise

Gold is making headlines, currently priced at $5,045 per ounce, reflecting a 1.2% increase. Precious metals, including silver, have also reached new highs, with silver trading at $109 per ounce—up 5.6%.

This surge is attributed to a growing distrust in the US dollar and the global economic framework. Analysts note that the trend indicates a shift in how investors view precious metals, transitioning from mere hedges to core assets.

Factors Influencing Precious Metals

Several factors contribute to the robust demand for gold and silver:

- Increased physical demand from investors.

- Central banks diversifying reserve assets away from the US dollar.

- Institutional trust issues in currencies and economic stability.

According to Metals Focus, analysts predict that gold prices could peak at approximately $5,500 in 2026. This trajectory appears more indicative of systemic strain in the financial landscape than temporary market fluctuations.

Looking Ahead

With the ASX preparing for strong gains today, market watchers will be keen to observe ongoing trends in gold and other precious metals. As investor behavior shifts, the implications for global finance and asset allocation are profound.