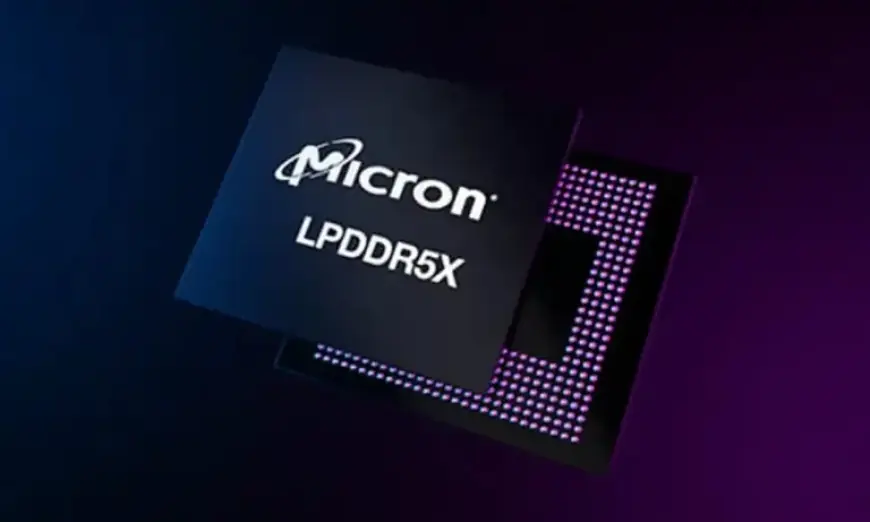

Top Undervalued Chip Stock to Invest in by 2026

The semiconductor industry is experiencing a transformative phase, driven by a significant demand for advanced chips. This has created a unique investment opportunity, particularly in undervalued chip stocks, as the market grapples with a memory shortage that may persist into 2027.

Market Demand and Opportunities

Leading companies such as Micron Technology are navigating a dynamic landscape. Despite the surge in demand for chips in data centers, not all stocks are receiving equal valuations. Some industry leaders are undervalued compared to their peers.

Valuation Discrepancies

Currently, investors are paying premium prices for consistent performers like Nvidia, reflecting a higher price-to-earnings (P/E) ratio. In contrast, Micron’s valuation appears more attractive, trading at just 11 times forward earnings estimates. This is significantly lower than Nvidia’s forward P/E of 24 and Advanced Micro Devices (AMD) at 35.

- Micron’s projected earnings growth: 50% annually over the next few years

- AMD’s projected earnings growth: 45%

- Nvidia’s projected earnings growth: 36%

Micron offers a compelling risk-reward trade-off for investors. Wall Street forecasts earnings growth of 294% this year, resulting in earnings per share of $32.67, and a further increase of 27% next year, reaching $41.54 per share. This positive trajectory is bolstered by an increase in memory prices, particularly driven by demand for data center graphics processing units (GPUs).

Customer Commitments and Future Growth

Micron’s recent performance highlights strong revenue growth, which rose 57% year-over-year last quarter, while earnings increased by 175%. Management has indicated that customer commitments for high-bandwidth memory through 2026 are already in place, ensuring a stable demand outlook.

Factors Influencing Future Performance

A report from the International Data Corporation (IDC) suggests the memory shortage may continue into 2027. A significant factor contributing to this situation is Nvidia’s forthcoming Rubin chips, designed to deliver higher memory bandwidth for advanced AI tasks. Each new generation of Nvidia chips increases the potential for Micron’s products.

Risks to Consider

Despite the promising outlook, investors must remain cautious of potential oversupply. Should memory production surpass demand, it could lead to excess inventory and decreasing prices, which would negatively impact Micron’s profits. However, current customer commitments and robust demand for Nvidia’s data center products mitigate this risk in the near term.

Conclusion

Micron Technology stands out as a potentially undervalued chip stock to consider by 2026. With its solid growth forecast, attractive valuation, and strong demand fundamentals, investors may find considerable upside in this semiconductor leader.

Key Data Points

| Current Price | $388.83 |

| Market Cap | $450B |

| Day’s Range | $384.39 – $398.00 |

| 52-week Range | $61.54 – $412.43 |

| Volume | 382K |

| Avg Volume | 29M |

| Gross Margin | 45.53% |

| Dividend Yield | 0.12% |