Rippling/Deel Corporate Espionage Scandal Escalates Further

The corporate rivalry between payroll company Deel and its competitor Rippling has escalated into serious allegations of corporate espionage. Reports from The Wall Street Journal indicate that the Department of Justice is conducting a criminal investigation into Deel for allegedly hiring a corporate spy to gather intelligence on Rippling.

Details of the Investigation

Deel has publicly stated that it is unaware of any investigation but insists on cooperating with authorities. The company has countered allegations by claiming that Rippling has launched a “smear campaign” against it.

- Investigation Status: Department of Justice is probing Deel.

- Deel’s Response: Claims no awareness of the investigation but will cooperate.

- Allegations by Deel: Accuses Rippling of a smear campaign.

Background of the Rivalry

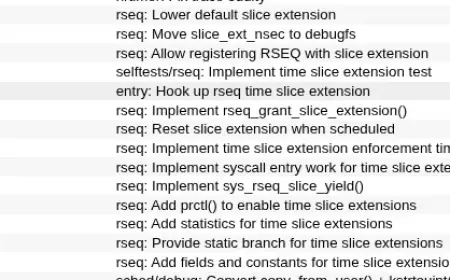

The situation began in May, when Rippling filed a lawsuit against Deel, alleging that it had employed a corporate spy to infiltrate its operations. This claim was reportedly revised in June.

A key piece of evidence includes a sworn statement from an individual caught in a sting operation. This individual confessed to being a paid spy for Deel, admitting to stealing sensitive information like sales leads and customer accounts from Rippling.

Legal Proceedings

- Lawsuit Details:

- Rippling’s lawsuit cites violations of the federal racketeering law.

- Deel responded with a countersuit alleging Rippling’s impersonation of a customer.

- Importance of the Case: It represents one of the largest corporate legal battles in the HR startup sector.

Rippling recently won a significant legal victory by obtaining bank records that reportedly show a transfer of funds from Deel to the spy. This evidence adds credibility to Rippling’s accusations.

Legal Representation

Deel’s CEO, Alexandre Bouaziz, has enlisted high-profile attorney William Frentzen, known for his work in corporate and securities fraud. Meanwhile, Rippling’s legal team is led by Alex Spiro, a prominent attorney with an impressive client roster.

Financial Impact

Despite ongoing legal challenges, both companies continue to attract substantial investor interest. In October, Deel celebrated a valuation of $17.3 billion, fueled by a $300 million fundraising round. Conversely, Rippling achieved a $16.8 billion valuation in May after securing $450 million from various investors.

The ongoing dispute is shaping up to be one of the most dramatic episodes in the corporate world, with elements reminiscent of legal thrillers. As both sides prepare for the courtroom battle, the implications for the future of both companies remain profound.