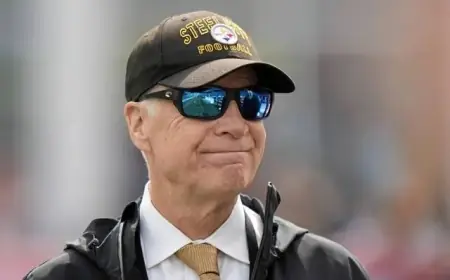

Fed Rate Decision: Jerome Powell’s Press Conference Holds Key Market Impact

The Federal Reserve’s upcoming interest rate decision is highly anticipated by financial markets. Traders are particularly focused on Chairman Jerome Powell’s post-meeting press conference, as it may hold significant implications for both traditional and cryptocurrency markets.

Washington’s Rate Decision Overview

Following a series of three consecutive quarter-point cuts, the Fed is widely expected to maintain rates at the current level. As of the latest data from CME’s FedWatch futures, there is a staggering 96% probability that the Federal Reserve will keep the rates steady at 3.5%-3.75%. This aligns with Powell’s previous statements indicating that further cuts will likely be deferred until 2026.

Current Economic Climate

- Minneapolis Fed President Neel Kashkari believes that it is premature to cut rates.

- Predictions indicate that unless a surprise cut is announced, the decision may lack immediate significant market reaction.

Impacts of Powell’s Comments

The crux of the market anticipation lies in whether Powell’s comments will suggest a hawkish or dovish outlook. A hawkish pause could indicate persistent inflation concerns, whereas a dovish tone might signal readiness for future rate cuts. Morgan Stanley forecasts that the Fed may retain language suggesting potential for easing while acknowledging the economy’s resilience.

- A hawkish stance could dampen expectations for rate cuts and negatively impact risk assets.

- A dovish stance may revive hopes for economic support, likely benefiting cryptocurrencies like Bitcoin.

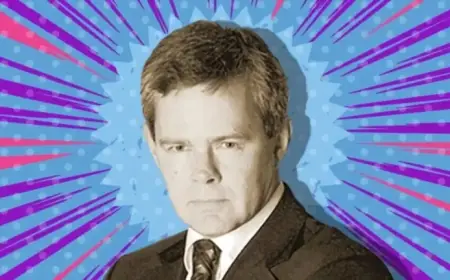

Potential Internal Dissent

Monitoring dissenters within the Federal Reserve is crucial. If more members oppose the pause, it may strengthen the case for future easing measures. Notably, Stephen Miran, appointed by former President Trump, might advocate for a substantial 50-basis-point cut.

Macroeconomic Factors and Trump’s Policies

Powell will likely address the rationale for maintaining the current rates and the influence of Trump’s policies on economic variables. Particularly, his comments could impact the strength of the U.S. dollar. Analysts from ING suggest that Powell will find it challenging to justify lower rates given the current financial landscape, which might bolster the dollar against weaker currencies.

- Trump’s policies include a potential $200 billion investment in mortgage-backed securities aimed at reducing housing costs.

- Impact of banning large institutional investors from purchasing single-family homes may be limited.

Moreover, Trump’s tariffs introduce delayed inflation effects, as increased import costs trickle down to consumers. Powell may also face questions about ongoing investigations against him, which he deems politically motivated.

Conclusion

With market participants on edge, Powell’s press conference will be critical for future economic forecasts. The Federal Reserve’s decisions will greatly influence both traditional markets and cryptocurrencies as they navigate potential changes in the economic landscape.