S.E.C. Dismisses Case Against Winklevoss Twins’ Cryptocurrency Firm

The Securities and Exchange Commission (S.E.C.) has officially dismissed its lawsuit against Gemini Trust, a prominent cryptocurrency exchange founded by Tyler and Cameron Winklevoss. This decision marks a significant shift in the S.E.C.’s enforcement approach toward the crypto industry, reflecting a broader trend under the current administration.

S.E.C. Case Against Gemini Trust Dismissed

The dismissal of the case was made public on a Friday in late September 2023. It stems from the aftermath of the 2022 collapse of the “Gemini Earn” investment program, which resulted in substantial losses for customers. Initially, many users lost access to their funds, totaling nearly $1 billion in assets. However, they eventually regained their investments after intervention from the New York Attorney General’s office.

Background on Gemini Trust

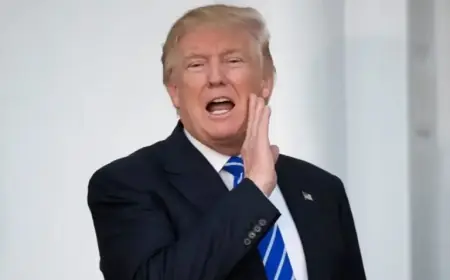

- Founders: Tyler and Cameron Winklevoss.

- Connections: Close allies of former President Donald Trump.

- Political Contributions: Fundraisers for Trump’s campaign and other Republican initiatives.

The Winklevoss twins have also been linked to various projects involving other members of the Trump family, including support for a crypto firm co-founded by Eric Trump.

Regulatory Changes Under Current Administration

The S.E.C.’s decision to drop the Gemini case highlights a shift in the regulatory landscape for cryptocurrency firms associated with Trump. Since the beginning of his second term, the S.E.C. has eased its enforcement on over 60% of pending crypto lawsuits. Gemini is the eighth firm to have its case dismissed in this trend.

Critics have questioned whether political favoritism influenced these decisions. However, the S.E.C. asserted that the agency’s shift in enforcement strategy was due to legal and policy considerations, rather than political influence.

Gemini Earn and Customer Impact

The “Gemini Earn” program allowed customers to lend digital assets to Genesis Global Capital in exchange for interest. Following Genesis’s bankruptcy, the program failed, leaving many customers stranded. They could withdraw their funds at any time, yet the program’s failure led to funds being frozen for a significant period.

Legal Developments and Settlements

- New York Settlement: Genesis agreed to a $2 billion settlement in May 2024.

- Gemini’s Commitment: They will pay up to $50 million to address any outstanding losses.

While Gemini acknowledges no wrongdoing, they have continuously defended their actions. Tyler Winklevoss referred to the lawsuit as a “manufactured parking ticket.”

Future of Cryptocurrency Regulation

The S.E.C. has signaled a potential pivot in its approach toward cryptocurrency regulation. For now, all ongoing cases seem focused on defendants without connections to the Trump family. Therefore, it appears that firms linked to the Trump administration may enjoy a less stringent regulatory environment moving forward.