Investors Own 17% of California Homes: Is It Too Much?

Investor ownership is a significant component of California’s housing market. Currently, investors hold around 17% of the state’s single-family homes, according to a report by BatchData. This statistic translates to approximately 1.3 million homes owned by various types of investors, which is the second-highest total in the United States.

Overview of Investor Ownership in California

California’s investor-owned homes make up about 8% of the total 15.6 million homes owned by investors nationwide. Texas tops the list with 1.4 million investor-owned homes, while Florida follows closely with 1.1 million. Here’s a quick comparison:

- California: 1.3 million homes (17%)

- Texas: 1.4 million homes (17.9%)

- Florida: 1.1 million homes (18%)

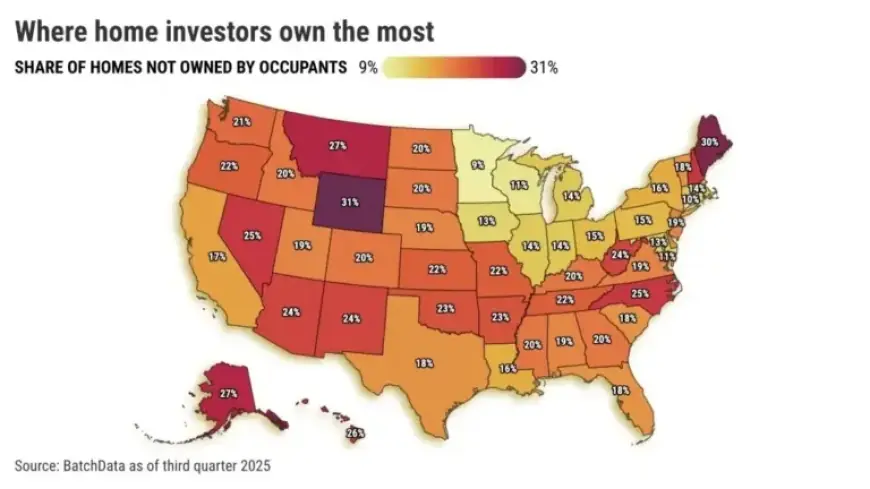

National Findings on Investor Ownership

Nationwide, 15.6 million residential properties are owned by investors. The distribution of investor ownership varies significantly by state. For example:

- Wyoming leads with a 31% investor ownership share.

- Maine follows at 30%, and Montana at 27%.

In contrast, states like Minnesota, Connecticut, and Washington, D.C. have the lowest investor shares, ranging from 9% to 11%.

The Impact of Investors on Housing Affordability

The role of investors in the housing market has stirred debate, particularly concerning pricing and affordability. Investors often buy properties as rental investments, thereby contributing to the overall supply of rental units. However, critics argue that their presence in the market complicates home ownership for prospective buyers.

Historically, the conversation around housing affordability has revolved around several key issues:

- The aftermath of the Great Recession, which temporarily alleviated some affordability issues.

- Ongoing construction challenges and the belief that more homes would stabilize prices.

- The assertion that investors exacerbate affordability problems, particularly large-scale investors.

Current Investor Market Dynamics

Investor purchasing accounted for about 34% of all U.S. home sales in the third quarter of 2025. This represents a notable increase from 18.5% in 2020. Many argue that limiting investor participation might help lower prices by decreasing demand. However, experts suggest that this could lead to market instability.

Concluding Thoughts on Investor Ownership

The question of whether investor ownership is “too much” remains complex. While they provide essential housing options, their role also raises critical questions regarding the availability of affordable homes. With ongoing discussions about government policies and affordability programs, the dynamics between investors and homebuyers will likely continue to evolve.