S&P 500 Futures Rise, Japanese Bonds Rebound in Market Update

In a recent market update, S&P 500 futures experienced a rise of 0.3%. This follows a period of heightened volatility and losses in equity markets.

Japanese Bonds Rebound

Japanese bonds saw a recovery after a significant selloff impacted global debt markets. Specifically, yields on 40-year Japanese bonds decreased by 22 basis points, settling at 3.99%. This rebound came after Finance Minister Satsuki Katayama urged for calm amid tumultuous market conditions.

Key Events

- Date: Recent market update

- Context: Japanese bond yields peaked at all-time highs

- Response: Finance Minister Satsuki Katayama called for market stability

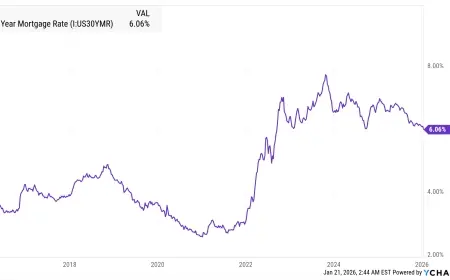

U.S. Markets and Treasuries

Accompanying the rebound in Japanese bonds, U.S. Treasuries also experienced a slight uptick. The movement in the bond market signals that investors may be finding some stability after recent turmoil.

Market Reactions

- S&P 500 Futures: Increased by 0.3%

- Treasuries: Showed signs of improvement

- Recent Performance: U.S. equity markets faced steep losses previously

Overall, both Japanese bonds and U.S. futures reflect a cautious optimism in the face of prior market declines. As volatility eases, investors remain hopeful for continued recovery.