Berkshire Hathaway’s Successor Plans to Sell 325M Kraft Heinz Shares

Warren Buffett’s successor, Greg Abel, is considering a significant change in Berkshire Hathaway’s investment strategy. Following his appointment as CEO in January 2023, Abel is reportedly evaluating the potential sale of 325 million shares in Kraft Heinz, a company Buffett helped form in 2015.

Kraft Heinz Shares Sale Under Consideration

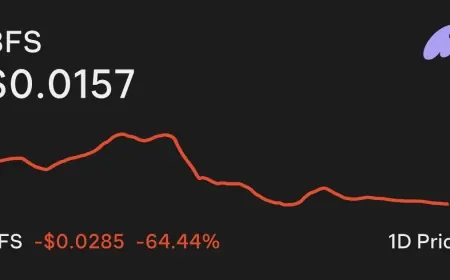

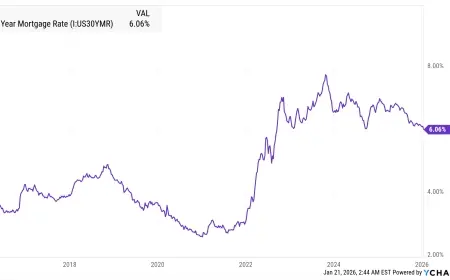

Kraft Heinz publicly disclosed in a recent regulatory filing that Berkshire Hathaway may proceed with the sale of its substantial stake, amounting to 325,442,152 shares. This announcement led to a nearly 4% drop in Kraft Heinz shares, bringing them down to approximately $22.85.

Background on Kraft Heinz and Berkshire Hathaway

- The merger of Kraft and Heinz was orchestrated by Buffett and 3G Capital in 2015.

- Berkshire Hathaway acquired its stake in Kraft Heinz for over $3.76 billion amid Buffett’s waning confidence in the company’s market position.

- Buffett noted last fall his disappointment with Kraft Heinz’s plan to split into two separate entities.

Abel, who has been managing Berkshire’s non-insurance companies since 2018, is now in a position to assess Berkshire’s extensive portfolio, valued at more than $300 billion. The analysis may lead to divestitures, which is a notable departure from Buffett’s historical approach of only making acquisitions.

Impacts on Berkshire’s Investment Philosophy

This potential sale signals a transformative moment for the conglomerate. Analyst Cathy Seifert speculates that Abel’s leadership might introduce a new mindset regarding corporate management. Historically, Berkshire under Buffett has avoided selling significant investments, even when prospects appeared dim.

Investor Chris Ballard noted that selling Kraft Heinz represents a straightforward option for Abel. However, he expressed concerns about the challenge of unloading such a large number of shares in the open market. Ballard speculated whether there could be a larger buyer interested in this significant shareholding.

As these events unfold, all eyes will be on Greg Abel and the strategic directions he may pursue for Berkshire Hathaway moving forward. Investors are keenly observing if Abel’s approach will differ notably from the philosophy established by Buffett over the past six decades.