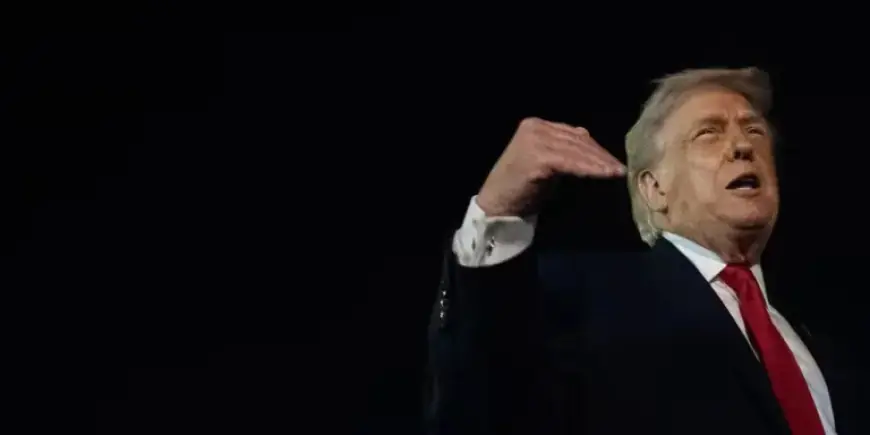

‘Sell America’ Trade Resurges Tuesday: Key Insights for Investors

The “Sell America” trade is gaining traction once more, driven by recent tariff threats from President Donald Trump against European nations. This resurgence has reignited volatility reminiscent of the market fluctuations experienced in April.

Market Reactions on Trade Developments

On January 20, 2026, U.S. stock markets experienced a downturn as trading resumed after a long holiday weekend. The tensions from the tariff threats led to a noticeable decline in stock values.

Treasury Yields and Currency Movements

The impact of these developments was significant. Treasury yields surged to levels not seen since the previous summer. Meanwhile, the value of the U.S. dollar also faced pressure, contributing to the overall decline in equity markets.

Global Financial Landscape

The ramifications were not confined to the U.S. Stock and bond markets worldwide saw a sell-off. In contrast, safe-haven assets experienced a rally:

- Gold and silver prices increased.

- The Swiss franc strengthened against the dollar.

As investors navigate this renewed phase of the “Sell America” trade, they must remain vigilant. Understanding the dynamics of global markets amid these tariff risks is crucial for informed financial decisions.