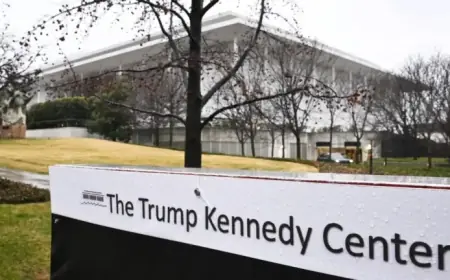

Equities Rebound Amid Greenland Concerns in Taco Time Rally

The recent performance of equities has shown signs of recovery, largely influenced by global concerns surrounding Greenland and the situational responses from U.S. officials. Recent actions from the government indicate a potential shift in focus within the financial markets.

Market Response to Greenland Concerns

The U.S. markets reacted positively, seeing a rebound as uncertainty surrounding Greenland gains traction. This includes significant pushback from political opposition, suggesting that the initial plans may not be fully grounded.

Key Influencers

- Scott Bessent: U.S. Treasury Secretary who is advising calm amidst the turmoil.

- Intel: Leading the S&P 500 with a notable increase of over 6%.

- AMD: Witnessed a 2.75% rise in its stock value.

- Micron: Achieved a 1.7% gain.

- Nvidia: Saw a decline of over 2% amid market fluctuations.

Stock Market Dynamics

Despite the volatility in the market this year, specifically among the “Magnificent 7” stocks, there has been noteworthy activity. Companies like Google experienced a decrease of 1.4%, highlighting the struggles of tech giants.

Supreme Court’s Impact

A recent decision by the Supreme Court regarding tariffs may have contributed to this uptick in market performance. With a ruling expected no sooner than February 20, the delay might help stabilize short-term market volatility.

Bond Market Developments

In the bond market, yields have declined slightly from previous highs. The U.S. 10-year Treasury yield peaked at 4.31% but has since adjusted to around 4.26%.

With discussions from Treasury Secretary Lutnick emphasizing that current interest rates are excessively high, market participants are paying close attention to further implications.

Conclusion

The interplay between governmental actions and market reactions underscores the current economic climate. Observers are keenly watching how these dynamics unfold amid ongoing concerns related to Greenland.