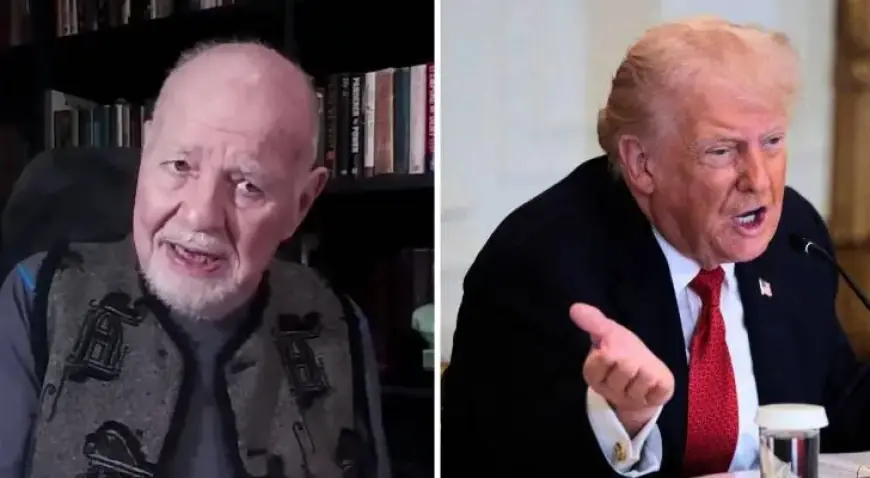

Economist Warns of 2026 Crash: Stocks, Real Estate at Risk if Trump Returns

Veteran economist Marc Faber has issued a grave warning about the future of U.S. markets, predicting a crash in 2026 if former President Donald Trump returns to power. His concerns focus on the potential risks facing both the stock market and the real estate sector, which he describes as being in a “colossal bubble.”

Economic Outlook for 2026

Despite a strong finish to 2025, with the S&P 500 rising approximately 16%, Faber believes 2026 will be far less favorable. He foresees what he terms a “doom” scenario, attributing this to prolonged inflation and the consequences of decades of monetary policy. Notably, he is troubled by the current interest rate environment, suggesting that any considerable movement in rates will unsettle the stock market.

Interest Rates and Market Concerns

- The current yield on the 10-year Treasury is around 4%.

- Faber suggests that actual living costs are rising significantly faster, estimating an increase of 6% to 12% per year.

- He cautions that interest rates are not high in real terms, contributing to an inflationary scenario.

Faber also highlighted investor behavior as a warning sign, noting the excessive trading in popular stocks like Tesla and Nvidia. He warns that this leverage indicates an overabundance of liquidity, typical of a market bubble.

Real Estate Market at Risk

The real estate market also faces challenges. Faber claims that residential real estate, typically a significant asset for the middle class, is at risk of considerable depreciation. He views the potential return of Trump as a complicating factor that could further disrupt both markets.

Investment Strategy During Inflation

In an environment where he predicts trouble for stocks and real estate, Faber encourages investment in precious metals, particularly gold and silver, regarded as safer assets. He believes these metals could continue to appreciate in value amid economic uncertainty.

- Gold and silver are considered reliable hedge assets during inflationary times.

- Faber states that many investors hold minimal gold relative to their total assets.

- JPMorgan CEO Jamie Dimon notes that gold could rise significantly, potentially reaching $10,000 an ounce.

Faber also emphasizes the importance of dividends, advocating for high-dividend-paying stocks as an alternative investment strategy. He acknowledges that while stock selection is crucial, focusing on companies with strong cash flow supports sustainable dividends.

Alternative Investment Options

For diversifying portfolios beyond stocks and bonds, Faber and other experts suggest exploring alternative assets. Collectibles and art have gained attention as viable options, with the latter historically outpacing stock market performance due to its limited supply.

The investment landscape is constantly evolving, and individuals should consider various factors, including their investment goals and risk tolerance. For those unsure where to begin, consulting a financial advisor may be beneficial.

Final Thoughts

As economists like Marc Faber warn of a potential downturn in 2026, it is essential for investors to remain vigilant. Preparing for economic fluctuations through strategic investments could mitigate risks and help protect individual assets during turbulent times, whether in the stock market or real estate sector.