TSMC Reports Record Q4 Earnings Amid Surging AI Demand

TSMC has reported remarkable financial performance for the fourth quarter of the year, driven by increasing demand for artificial intelligence (AI) technologies. The semiconductor manufacturer achieved a net income of NT$505.7 billion, equivalent to approximately $16 billion. This figure represents a 35 percent increase compared to the previous year and surpassed analyst expectations.

Record Revenue and Growth Projections

The company’s revenue reached $33.7 billion, marking a 25.5 percent rise from the same quarter in the prior year. TSMC is optimistic about future growth, projecting nearly a 30 percent increase in revenue by 2026. To support this expansion, the company plans to allocate between $52 billion and $56 billion toward capital expenditures in the upcoming year, a significant increase from the $40.9 billion budgeted for 2025.

Industry Outlook Amid Speculation

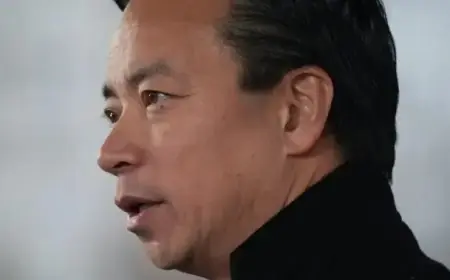

Despite ongoing debates about a potential AI bubble, TSMC’s leadership is confident in the sector’s trajectory. Recent comments from industry leaders raised concerns about sustainability in the AI market. Google CEO Sundar Pichai cautioned about “irrationality” surrounding AI investments, while OpenAI’s Sam Altman remarked on excessive enthusiasm among investors, hinting at possible financial losses.

In stark contrast, TSMC’s CEO, C.C. Wei, remains encouraged by direct interactions with cloud service providers. Wei stated that he sought to confirm the authenticity of demand, saying, “I want to make sure that my customers’ demands are real.” He expressed satisfaction with the responses received, indicating a solid foundation for continued investment in AI chip manufacturing.

TSMC’s Strategic Moves

- Direct Engagement: Wei’s discussions with cloud providers reaffirmed the robust demand for AI technologies.

- Capital Investment: Planned expenditures reflect TSMC’s commitment to expansion and meeting market needs.

- Trade Agreements: The U.S. and Taiwan have finalized a trade deal, reducing tariffs on Taiwanese goods from 20 percent to 15 percent.

This trade agreement obligates Taiwanese firms to invest $250 billion directly in the U.S., coinciding with TSMC’s accelerated efforts to expand its chip fabrication facilities in Arizona. With strong financial results and proactive strategies, TSMC positions itself as a key player in the booming AI market.