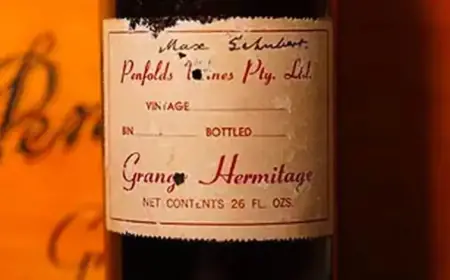

Australia’s Largest Winemaker Impacted by Decline in Chinese Banquets

Treasury Wine Estates, Australia’s largest winemaker, is experiencing significant challenges primarily due to a decline in sales linked to recent shifts in the Chinese market. The government’s crackdown on lavish banquets and restrictions on alcohol consumption have drastically altered the landscape for alcohol sales in China.

Impact of Chinese Banquets on Treasury Wine Estates

In February 2026, Treasury Wine announced its strategy to combat dwindling sales. The company revealed plans to reduce shipments to both the United States and China in an effort to regain control over supply chains and pricing structures. This move comes as the appetite for wine in China continues to wane.

Reduction in Shipments

- Treasury Wine Estates plans to cut wholesaler holdings in China by 400,000 cases.

- Shipments to the US will also decrease by 500,000 cases.

- The company is targeting a reduction in sales across other Asian markets to control reselling into China.

Sam Fischer, the new CEO of Treasury Wine, commented on the importance of managing the grey market to protect the brand’s positioning. This adjustment comes after a significant 10.1 percent decline in net sales revenue for Penfolds during the first half of the 2026 financial year.

Challenges Faced

Treasury Wine Estates’ difficulties stem from multiple factors. The company suffered a steep loss of nearly $650 million after tax, primarily linked to a writedown in its Americas division. Additionally, earnings plummeted by 66 percent, and sales revenue dipped by 16 percent compared to the same period in the previous year.

Market Conditions and Policy Changes

The decline in demand for ultra-luxury wines in China raises concerns about Treasury’s long-term margins and market stability. The Chinese Communist Party’s tightening of regulations around extravagant consumption, such as banning expensive dishes and drinks at official events, has hit wine demand hard.

- The 2019 trade between Australia and China was valued at $1.1 billion annually.

- Relations worsened following the imposition of steep tariffs on Australian wine in 2020.

- In March 2024, the tariffs were lifted, leading to initial optimism about reviving trade.

Future Prospects

The company has initiated a cost-cutting program known as TWE Ascent, aiming for $100 million in annual savings. Fischer emphasized that this program is essential for establishing a more robust and resilient business moving forward.

As Treasury Wine Estates navigates these challenging conditions, analysts predict a lengthy recovery process to restore consumer trust and adjust to the new market dynamics.