Iconic Australian Winery Faces $650 Million Loss

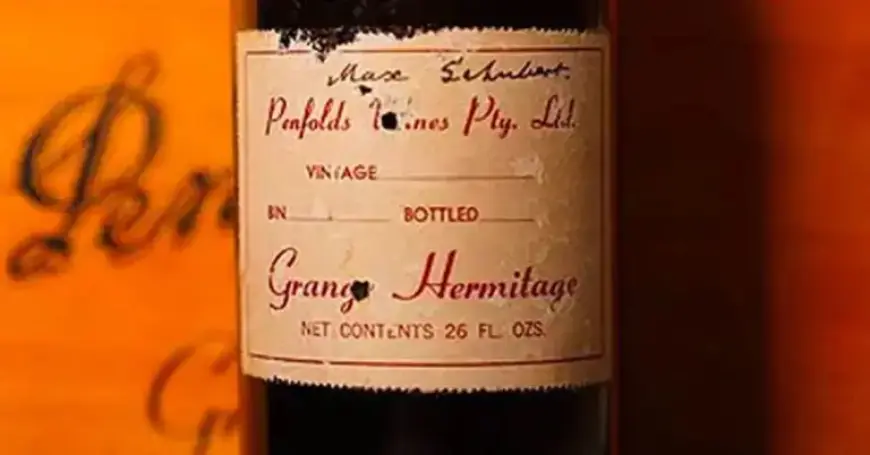

The renowned Australian wine producer Treasury Wine Estates (TWE), known for its prestigious Penfolds Wines, recently reported a staggering loss of approximately $650 million. This announcement reflects challenges within the global wine market and has significant implications for the company’s financial strategy.

Treasury Wine Estates Faces Financial Setbacks

In their latest financial report, TWE revealed a net profit after tax (NPAT) loss of $694.4 million for the fiscal year 2026. As a result of these financial struggles, the company has decided to suspend its interim dividend payments.

Leadership and Future Outlook

Sam Fischer, who became CEO just last October, expressed optimism about the company’s recovery efforts. “We are making meaningful progress with the decisive actions required to return TWE to a path of sustainable, profitable growth,” he stated.

- Treasury Wine Estates is focusing on strengthening its operational execution.

- The company aims to build a more resilient business for the long term.

Portfolio Impact and Market Challenges

Treasury Wine Estates’ portfolio includes several notable labels such as DAOU, Stags’ Leap, and 19 Crimes. Unfortunately, the company faced major losses in the American market, recording $751 million in impairments. Profits from the Americas plummeted nearly 64%.

- Penfolds division profits declined by almost 20%.

- Despite losses, the Penfolds brand continues to maintain its market strength.

Future Projections

Fischer remains hopeful for an upturn, anticipating improved profitability in the second half of the year, particularly as the Californian market shows signs of revival. The commitment to key brands is aimed at enhancing consumer confidence and fostering performance improvements.

As TWE navigates this financial turbulence, its strategic focus remains on transformation and resilience in a challenging international environment.